The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards iRobot Corporation (NASDAQ:IRBT) .

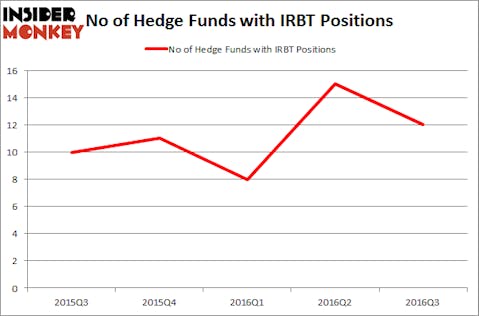

Is iRobot Corporation (NASDAQ:IRBT) a good stock to buy? The best stock pickers are actually becoming less confident. The number of bullish hedge fund bets fell by 3 right before the 30+% increase in stock price. IRBT was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. There were 15 hedge funds in our database with IRBT holdings on June 30th. At the end of this article we will also compare IRBT to other stocks including COMSCORE, Inc. (NASDAQ:SCOR), ESCO Technologies Inc. (NYSE:ESE), and Kaman Corporation (NYSE:KAMN) to get a better sense of its popularity.

Follow Irobot Corp (NASDAQ:IRBT)

Follow Irobot Corp (NASDAQ:IRBT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Tatiana Shepeleva/Shutterstock.com

Now, let’s analyze the new action regarding iRobot Corporation (NASDAQ:IRBT).

What have hedge funds been doing with iRobot Corporation (NASDAQ:IRBT)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -20% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards IRBT over the last 5 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the biggest position in iRobot Corporation (NASDAQ:IRBT), worth close to $19.8 million, comprising 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Columbus Circle Investors, with a $19 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism consist of Chuck Royce’s Royce & Associates, Renaissance Technologies, one of the largest hedge funds in the world and John Overdeck and David Siegel’s Two Sigma Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.