At Insider Monkey, we track over 700 of the most successful hedge funds in the world and analyze their top stock picks so as to gain insight into their collective buying habits. Despite redemptions totaling about $67 billion this year, hedge funds’ assets under management have risen to $3.24 trillion thanks to gains of 5.44% this year. While hedge funds continue to underperform the market, we have found that they excel at picking stocks on the long side of their portfolios, while generally not faring as well with their other investments, which drags down their overall returns. For example, their top-30 mid-cap stock picks delivered 18% returns during the 12-month period ended November 21, 2016, while the S&P 500 Index posted gains of less than half that (7.6%). This is why we share the top picks and trends among the group of hedge funds that we follow with readers, and why in this article, we’ll see how they’ve recently traded Intercontinental Exchange Inc (NYSE:ICE).

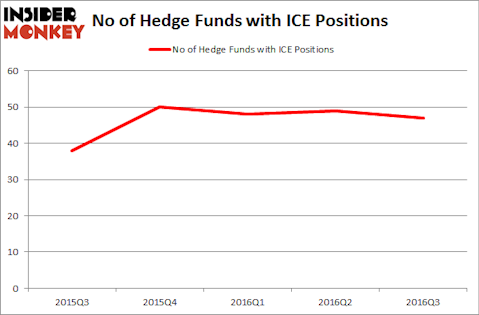

Intercontinental Exchange Inc (NYSE:ICE) shareholders have witnessed a decrease in activity from the world’s largest hedge funds recently. ICE was included in the equity portfolios of 47 funds from our database at the end of the third quarter of 2016, compared to 49 funds at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Crown Castle International Corp. (NYSE:CCI), Canon Inc. (ADR) (NYSE:CAJ), and American Electric Power Company, Inc. (NYSE:AEP) to gather more data points.

Follow Intercontinentalexchange Inc (NYSE:ICE)

Follow Intercontinentalexchange Inc (NYSE:ICE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Inozemtsev Konstantin/Shutterstock.com

Now, let’s go over the new action encompassing Intercontinental Exchange Inc (NYSE:ICE).

What have hedge funds been doing with Intercontinental Exchange Inc (NYSE:ICE)?

At Q3’s end, a total of 47 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ICE over the last five quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Stephen Mandel’s Lone Pine Capital has the number one position in Intercontinental Exchange Inc (NYSE:ICE), worth close to $325.2 million, accounting for 1.5% of its total 13F portfolio. On Lone Pine Capital’s heels is Cantillon Capital Management, led by William von Mueffling, which holds a $278.9 million position; 3.9% of its 13F portfolio is allocated to the company. Some other peers with similar optimism contain Ricky Sandler’s Eminence Capital, Jonathon Jacobson’s Highfields Capital Management, and Panayotis Takis Sparaggis’s Alkeon Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually said goodbye to their positions entirely. Intriguingly, Andreas Halvorsen’s Viking Global said goodbye to the largest stake of all the investors tracked by Insider Monkey, totaling close to $290.1 million in stock. Louis Bacon’s fund, Moore Global Investments, also dropped its stock, about $16.7 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Intercontinental Exchange Inc (NYSE:ICE) but similarly valued. These stocks are Crown Castle International Corp. (NYSE:CCI), Canon Inc. (ADR) (NYSE:CAJ), American Electric Power Company, Inc. (NYSE:AEP), and Pioneer Natural Resources (NYSE:PXD). This group of stocks’ market caps are closest to ICE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCI | 42 | 1954931 | -2 |

| CAJ | 5 | 36687 | -1 |

| AEP | 32 | 1274137 | 5 |

| PXD | 72 | 4119576 | -2 |

As you can see these stocks had an average of 38 funds with bullish positions and the average amount invested in these stocks was $1.85 billion. That figure was $2.40 billion in ICE’s case. Pioneer Natural Resources (NYSE:PXD) is the most popular stock in this table, while Canon Inc. (ADR) (NYSE:CAJ) is the least popular one with only five investors reporting positions. Intercontinental Exchange Inc (NYSE:ICE) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PXD might be a better candidate to consider taking a long position in.

Disclosure: none