We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Interactive Brokers Group, Inc. (IEX:IBKR).

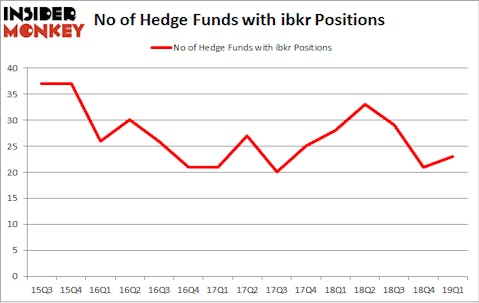

Interactive Brokers Group, Inc. (IEX:IBKR) has seen an increase in enthusiasm from smart money of late. Our calculations also showed that ibkr isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the new hedge fund action encompassing Interactive Brokers Group, Inc. (IEX:IBKR).

How are hedge funds trading Interactive Brokers Group, Inc. (IEX:IBKR)?

Heading into the second quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from one quarter earlier. On the other hand, there were a total of 28 hedge funds with a bullish position in IBKR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Brian Bares’s Bares Capital Management has the most valuable position in Interactive Brokers Group, Inc. (IEX:IBKR), worth close to $372.7 million, amounting to 10.5% of its total 13F portfolio. On Bares Capital Management’s heels is Cantillon Capital Management, led by William von Mueffling, holding a $135.9 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish consist of Robert Joseph Caruso’s Select Equity Group, Quincy Lee’s Ancient Art (Teton Capital) and Allan Mecham and Ben Raybould’s Arlington Value Capital.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Bronte Capital, managed by John Hempton, initiated the most outsized position in Interactive Brokers Group, Inc. (IEX:IBKR). Bronte Capital had $23.4 million invested in the company at the end of the quarter. Alexander Captain’s Cat Rock Capital also initiated a $4.7 million position during the quarter. The other funds with brand new IBKR positions are Sander Gerber’s Hudson Bay Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and D. E. Shaw’s D E Shaw.

Let’s also examine hedge fund activity in other stocks similar to Interactive Brokers Group, Inc. (IEX:IBKR). These stocks are Lululemon Athletica inc. (NASDAQ:LULU), Imperial Oil Limited (NYSE:IMO), United Continental Holdings Inc (NASDAQ:UAL), and Cintas Corporation (NASDAQ:CTAS). This group of stocks’ market caps match IBKR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LULU | 42 | 1770036 | 6 |

| IMO | 17 | 85055 | -2 |

| UAL | 49 | 6333893 | 0 |

| CTAS | 27 | 525445 | -2 |

| Average | 33.75 | 2178607 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.75 hedge funds with bullish positions and the average amount invested in these stocks was $2179 million. That figure was $941 million in IBKR’s case. United Continental Holdings Inc (NASDAQ:UAL) is the most popular stock in this table. On the other hand Imperial Oil Limited (NYSE:IMO) is the least popular one with only 17 bullish hedge fund positions. Interactive Brokers Group, Inc. (IEX:IBKR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on IBKR, though not to the same extent, as the stock returned 1% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.