Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost around 20%. Facebook, which was the second most popular stock, lost 14% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

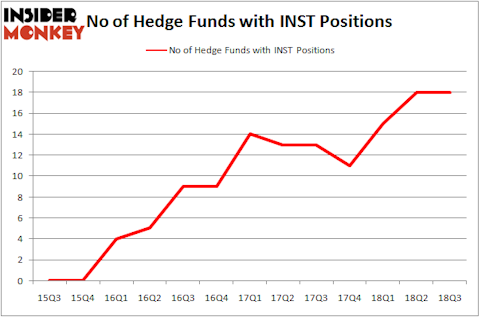

Instructure, Inc. (NYSE:INST) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Intellia Therapeutics, Inc. (NASDAQ:NTLA), PennyMac Mortgage Investment Trust (NYSE:PMT), and Systemax Inc. (NYSE:SYX) to gather more data points.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the latest hedge fund action surrounding Instructure, Inc. (NYSE:INST).

How are hedge funds trading Instructure, Inc. (NYSE:INST)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards INST over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Instructure, Inc. (NYSE:INST) was held by Nine Ten Partners, which reported holding $110.1 million worth of stock at the end of September. It was followed by EastBay Asset Management with a $12.1 million position. Other investors bullish on the company included Portolan Capital Management, Skye Global Management, and Millennium Management.

Due to the fact that Instructure, Inc. (NYSE:INST) has witnessed declining sentiment from the aggregate hedge fund industry, logic holds that there exists a select few funds that slashed their entire stakes heading into Q3. It’s worth mentioning that Amish Mehta’s SQN Investors said goodbye to the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at close to $38 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund dropped about $14.7 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Instructure, Inc. (NYSE:INST). These stocks are Intellia Therapeutics, Inc. (NASDAQ:NTLA), PennyMac Mortgage Investment Trust (NYSE:PMT), Systemax Inc. (NYSE:SYX), and Astronics Corporation (NASDAQ:ATRO). This group of stocks’ market caps resemble INST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTLA | 10 | 52186 | 1 |

| PMT | 7 | 18726 | 1 |

| SYX | 14 | 26840 | 1 |

| ATRO | 10 | 75456 | 2 |

| Average | 10.25 | 43302 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $43 million. That figure was $159 million in INST’s case. Systemax Inc. (NYSE:SYX) is the most popular stock in this table. On the other hand PennyMac Mortgage Investment Trust (NYSE:PMT) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Instructure, Inc. (NYSE:INST) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.