Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Insmed Incorporated (NASDAQ:INSM) from the perspective of those elite funds.

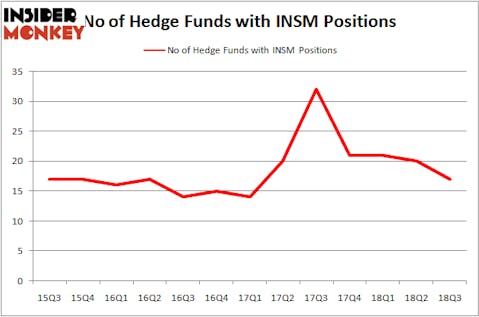

Insmed Incorporated (NASDAQ:INSM) was in 17 hedge funds’ portfolios at the end of the third quarter of 2018. INSM has experienced a decrease in hedge fund interest recently. There were 20 hedge funds in our database with INSM positions at the end of the previous quarter. Our calculations also showed that INSM isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action encompassing Insmed Incorporated (NASDAQ:INSM).

What does the smart money think about Insmed Incorporated (NASDAQ:INSM)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the previous quarter. By comparison, 21 hedge funds held shares or bullish call options in INSM heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Palo Alto Investors held the most valuable stake in Insmed Incorporated (NASDAQ:INSM), which was worth $148.8 million at the end of the third quarter. On the second spot was Baker Bros. Advisors which amassed $37.4 million worth of shares. Moreover, OrbiMed Advisors, Adage Capital Management, and Rock Springs Capital Management were also bullish on Insmed Incorporated (NASDAQ:INSM), allocating a large percentage of their portfolios to this stock.

Seeing as Insmed Incorporated (NASDAQ:INSM) has experienced bearish sentiment from hedge fund managers, it’s easy to see that there exists a select few hedge funds that elected to cut their positions entirely in the third quarter. It’s worth mentioning that Jeremy Green’s Redmile Group dumped the largest position of the “upper crust” of funds followed by Insider Monkey, totaling close to $48.1 million in stock. Anand Parekh’s fund, Alyeska Investment Group, also dropped its stock, about $9.1 million worth. These moves are important to note, as total hedge fund interest fell by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks similar to Insmed Incorporated (NASDAQ:INSM). These stocks are Rush Enterprises, Inc. (NASDAQ:RUSHB), Sonic Corporation (NASDAQ:SONC), Tri Continental Corporation (NYSE:TY), and AK Steel Holding Corporation (NYSE:AKS). This group of stocks’ market valuations are similar to INSM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RUSHB | 5 | 36169 | 1 |

| SONC | 20 | 99389 | 7 |

| TY | 2 | 5894 | 0 |

| AKS | 20 | 75929 | 0 |

| Average | 11.75 | 54345 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.75 hedge funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $311 million in INSM’s case. Sonic Corporation (NASDAQ:SONC) is the most popular stock in this table. On the other hand Tri Continental Corporation (NYSE:TY) is the least popular one with only 2 bullish hedge fund positions. Insmed Incorporated (NASDAQ:INSM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SONC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.