Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 20 stock picks easily bested the broader market, at 18.7% compared to 12.1%, despite there being a few duds in there like Berkshire Hathaway (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

Hyatt Hotels Corporation (NYSE:H) investors should pay attention to a decrease in enthusiasm from smart money recently. Our calculations also showed that h isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the new hedge fund action regarding Hyatt Hotels Corporation (NYSE:H).

How have hedgies been trading Hyatt Hotels Corporation (NYSE:H)?

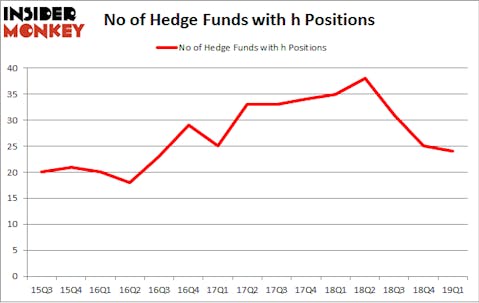

At the end of the first quarter, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. By comparison, 35 hedge funds held shares or bullish call options in H a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

The largest stake in Hyatt Hotels Corporation (NYSE:H) was held by Select Equity Group, which reported holding $279.7 million worth of stock at the end of March. It was followed by Long Pond Capital with a $180.5 million position. Other investors bullish on the company included D E Shaw, AQR Capital Management, and Renaissance Technologies.

Because Hyatt Hotels Corporation (NYSE:H) has witnessed falling interest from the smart money, we can see that there is a sect of money managers that decided to sell off their full holdings heading into Q3. At the top of the heap, Ray Dalio’s Bridgewater Associates dropped the largest position of the 700 funds tracked by Insider Monkey, comprising an estimated $3.2 million in stock, and David Rodriguez-Fraile’s BlueMar Capital Management was right behind this move, as the fund dumped about $1.8 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Hyatt Hotels Corporation (NYSE:H) but similarly valued. These stocks are Kilroy Realty Corp (NYSE:KRC), Pentair plc (NYSE:PNR), RPM International Inc. (NYSE:RPM), and US Foods Holding Corp. (NYSE:USFD). This group of stocks’ market values match H’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KRC | 11 | 140109 | -2 |

| PNR | 28 | 675196 | 3 |

| RPM | 21 | 384411 | -2 |

| USFD | 40 | 1340524 | -1 |

| Average | 25 | 635060 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $635 million. That figure was $762 million in H’s case. US Foods Holding Corp. (NYSE:USFD) is the most popular stock in this table. On the other hand Kilroy Realty Corp (NYSE:KRC) is the least popular one with only 11 bullish hedge fund positions. Hyatt Hotels Corporation (NYSE:H) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on H, though not to the same extent, as the stock returned 0% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.