Activist hedge fund HG Vora Capital made dramatic changes to its equity portfolio during the second quarter which is why we decided to take a closer look at this fund’s recent moves. HG Vora was founded by Parag Vora in 2009. Parag Vora honed his skills at Silver Point Capital and Goldman Sachs. At Silver Point Capital was primarily working on distressed situations and credit. “HG Vora Capital usually invests in actively traded debt and equity instruments on a long and short basis, seeking for businesses that are in the process of some kind of strategic change or with near term operational challenges. Main areas HG Vora Capital likes to invest in include gaming, real estate, travel, leisure, retail and consumer, and lodging. The fund seeks for mispriced securities,” we wrote last September.

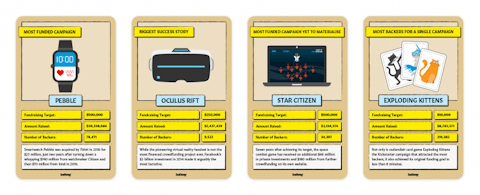

Others have found prosperity by capitalizing on the dreams of the general public using Kickstarter as a medium to invest. Over the last ten years, the online crowd funder has brought $4.2bn to entrepreneurs. Although potentially a higher risk, success stories like the case of the Oculus rift brought in $2.4 million in only a month. In lieu of traditional investment giving back monetary gains, investors on the platform received commodities as a compensation for investment. Kickstarter has proven to be a type of online emerging market in its own rights over the last ten years – and provides an interesting rival to traditional stocks and bonds. Check out the handy infographic by Betway outlining some of the boom and busts of the last decade.

As of August 2018 HG Vora Capital delivered an annualized return of 14% and amassed $4 billion in assets under management.

HG Vora Capital’s 14% annualized return is nothing to sneeze at but our flagship long/short strategies generated a cumulative return of 65% over the last 2.5 with zero net market exposure. Insider Monkey’s flagship long strategy identifies the best performing 100 hedge funds at the end of each quarter and invests in their consensus stock picks. This way it is always invested in the best ideas of the best performing hedge funds and is able to generate much higher returns than the market (see the details here). Last year HG Vora was ranked among our 100 best performing hedge funds list, so we took into account its holdings when we came up with our new “buy lists”.

According to the HG Vora Capital’s last 13F filing for the first quarter of 2019, the fund made large investments in gambling stocks. Three out of the top 4 positions in HG Vora’s 13F portfolio were gambling stocks. The biggest position is Caesars Entertainment Corp. According to Reuters HG Vora built a 4.9% stake in CZR last year to “persuade it to explore options that could include divestitures or an outright sale of the company”. Last month Caesers Entertainment agreed to sell itself to Eldorado Entertainment for $8.6 billion in cash and stock. CZR shares returned nearly 70% so far in 2019.

The third largest stake in HG Vora’s 13F portfolio is another hedge fund favorite: The Stars Group Inc. (TSG). TSG is aiming to become a major player in the global online betting market. It competes against global players but it has some catching up to do. At Q1’s end, a total of 44 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the fourth quarter of 2018. The largest stake in The Stars Group Inc. (NASDAQ:TSG) was held by HG Vora Capital Management, which reported holding $131.3 million worth of stock at the end of March. It was followed by Odey Asset Management Group with a $107.6 million position. Other investors bullish on the company included Tiger Legatus Capital, Indus Capital, and Harbor Spring Capital. TSG shares were flat this year.

The fourth largest stake in HG Vora’s 13F portfolio was Penn National Gaming, Inc (NASDAQ:PENN). At Q1’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 33% from the previous quarter. Of the funds tracked by Insider Monkey, HG Vora Capital Management held the most valuable position in Penn National Gaming, Inc. HG Vora Capital Management had a $116.6 million position in the stock, comprising 8.6% of its 13F portfolio. Coming in second was Blue Harbour Group, managed by Clifton S. Robbins, which held a $60.5 million position. PENN shares were also pretty much flat in 2019.

HG Vora Capital’s large bet on CZR is helping it deliver strong gains in 2019, but the two other gambling stocks look like losing bets in a market that’s up more than 20% in 2019.

Disclosure: No positions.