The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Heska Corp (NASDAQ:HSKA) from the perspective of those successful funds.

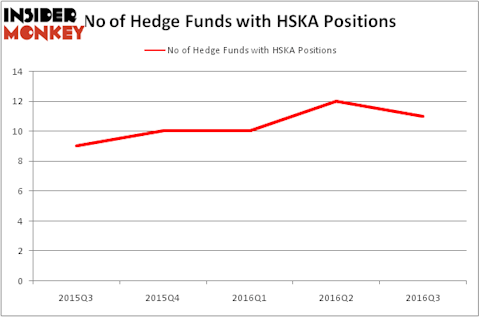

Heska Corp (NASDAQ:HSKA) was in 11 hedge funds’ portfolios at the end of the third quarter of 2016. HSKA has experienced a decrease in activity from the world’s largest hedge funds recently. There were 12 hedge funds in our database with HSKA positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Peapack-Gladstone Financial Corp (NASDAQ:PGC), China Cord Blood Corp (NYSE:CO), and Atlantic Capital Bancshares Inc (NASDAQ:ACBI) to gather more data points.

Follow Heska Corp (NASDAQ:HSKA)

Follow Heska Corp (NASDAQ:HSKA)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Lucky Business/Shutterstock.com

Keeping this in mind, let’s take a gander at the recent action regarding Heska Corp (NASDAQ:HSKA).

What have hedge funds been doing with Heska Corp (NASDAQ:HSKA)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decline of 8% from the second quarter of 2016. On the other hand, there were a total of 10 hedge funds with a bullish position in HSKA at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Park West Asset Management, led by Peter S. Park, holds the number one position in Heska Corp (NASDAQ:HSKA). According to its latest 13F filing, the fund has a $10.5 million position in the stock, comprising 1% of its 13F portfolio. The second most bullish fund manager is Millennium Management, one of the 10 largest hedge funds in the world, which holds a $5.6 million position; less than 0.1% of its 13F portfolio is allocated to the stock. Some other peers that hold long positions contain Richard Driehaus’s Driehaus Capital, Mario Gabelli’s GAMCO Investors and Cliff Asness’s AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.