Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

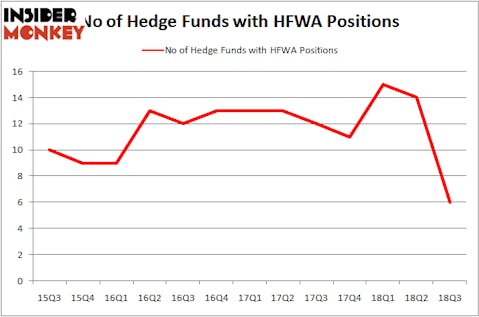

Heritage Financial Corporation (NASDAQ:HFWA) investors should pay attention to a decrease in enthusiasm from smart money of late. HFWA was in 6 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with HFWA holdings at the end of the previous quarter. Our calculations also showed that HFWA isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to check out the fresh hedge fund action surrounding Heritage Financial Corporation (NASDAQ:HFWA).

What have hedge funds been doing with Heritage Financial Corporation (NASDAQ:HFWA)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a change of -57% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in HFWA over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Heritage Financial Corporation (NASDAQ:HFWA) was held by Cardinal Capital, which reported holding $34.7 million worth of stock at the end of September. It was followed by Forest Hill Capital with a $14.5 million position. Other investors bullish on the company included Basswood Capital, AlphaOne Capital Partners, and Millennium Management.

Due to the fact that Heritage Financial Corporation (NASDAQ:HFWA) has faced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of money managers that elected to cut their full holdings last quarter. It’s worth mentioning that Richard Driehaus’s Driehaus Capital dropped the biggest position of the 700 funds monitored by Insider Monkey, comprising about $1.9 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund dumped about $1.8 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 8 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Heritage Financial Corporation (NASDAQ:HFWA) but similarly valued. We will take a look at Mammoth Energy Services, Inc. (NASDAQ:TUSK), Tactile Systems Technology, Inc. (NASDAQ:TCMD), Third Point Reinsurance Ltd (NYSE:TPRE), and WisdomTree Investments, Inc. (NASDAQ:WETF). All of these stocks’ market caps resemble HFWA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TUSK | 20 | 698342 | 1 |

| TCMD | 10 | 61036 | 1 |

| TPRE | 14 | 61383 | 1 |

| WETF | 12 | 69640 | 2 |

| Average | 14 | 222600 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $223 million. That figure was $72 million in HFWA’s case. Mammoth Energy Services, Inc. (NASDAQ:TUSK) is the most popular stock in this table. On the other hand Tactile Systems Technology, Inc. (NASDAQ:TCMD) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Heritage Financial Corporation (NASDAQ:HFWA) is even less popular than TCMD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.