The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Halliburton Company (NYSE:HAL).

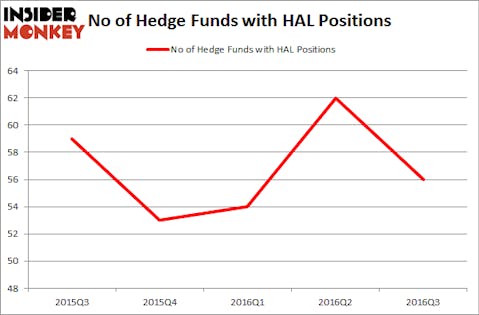

Among the funds we track, Halliburton Company (NYSE:HAL) was included in the equity portfolios of 56 funds at the end of the third quarter of 2016. However, Halliburton has seen a decrease in hedge fund sentiment, as there had been 62 funds in our database with HAL positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ), Illinois Tool Works Inc. (NYSE:ITW), and Sony Corporation (ADR) (NYSE:SNE) to gather more data points.

Follow Halliburton Co (NYSE:HAL)

Follow Halliburton Co (NYSE:HAL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

maradon 333/Shutterstock.com

Keeping this in mind, we’re going to view the fresh action regarding Halliburton Company (NYSE:HAL).

How have hedgies been trading Halliburton Company (NYSE:HAL)?

As stated earlier, heading into the fourth quarter of 2016, a total of 56 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 10% sequentially. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Daniel S. Och’s OZ Management has the most valuable position in Halliburton Company (NYSE:HAL), worth close to $212.5 million, amounting to 1.2% of its total 13F portfolio. Coming in second is First Pacific Advisors LLC, led by Robert Rodriguez and Steven Romick, holding a $167.6 million position; 1.4% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism contain Israel Englander’s Millennium Management, Richard S. Pzena’s Pzena Investment Management and Steve Cohen’s Point72 Asset Management.

Because Halliburton Company (NYSE:HAL) has experienced falling interest from the entirety of the hedge funds we track, we can see that there were a few money managers that slashed their full holdings in the third quarter. Interestingly, Daniel S. Och’s OZ Management sold off the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth about $216.1 million in stock. Stanley Druckenmiller’s fund, Duquesne Capital, also dumped all of its shares, about $98.6 million worth.

Let’s now review hedge fund activity in other stocks similar to Halliburton Company (NYSE:HAL). These stocks are PowerShares QQQ Trust, Series 1 (ETF) (NASDAQ:QQQ), Illinois Tool Works Inc. (NYSE:ITW), Sony Corporation (ADR) (NYSE:SNE), and Regeneron Pharmaceuticals Inc (NASDAQ:REGN). This group of stocks’ market values are closest to HAL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QQQ | 24 | 1423248 | 4 |

| ITW | 33 | 702872 | 1 |

| SNE | 13 | 327337 | -1 |

| REGN | 29 | 629847 | -3 |

As you can see these stocks had an average of 25 investors holding shares at the end of September and the average amount invested in these stocks was $771 million. By comparison, hedge funds held much more invested in Halliburton – $1.80 billion. Illinois Tool Works Inc. (NYSE:ITW) is the most popular stock in this table. On the other hand Sony Corporation (ADR) (NYSE:SNE) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Halliburton Company (NYSE:HAL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.