The Insider Monkey team has completed processing the quarterly 13F filings for the March quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Green Plains Inc. (NASDAQ:GPRE).

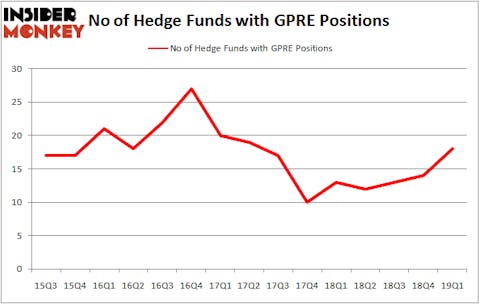

Is Green Plains Inc. (NASDAQ:GPRE) worth your attention right now? Prominent investors are taking an optimistic view. The number of bullish hedge fund bets increased by 4 in recent months. Our calculations also showed that GPRE isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals stock traders put to use to evaluate stocks. A duo of the most useful signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best investment managers can trounce the S&P 500 by a significant amount (see the details here).

We’re going to check out the new hedge fund action surrounding Green Plains Inc. (NASDAQ:GPRE).

What does the smart money think about Green Plains Inc. (NASDAQ:GPRE)?

Heading into the second quarter of 2019, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from the fourth quarter of 2018. By comparison, 13 hedge funds held shares or bullish call options in GPRE a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Among these funds, Mangrove Partners held the most valuable stake in Green Plains Inc. (NASDAQ:GPRE), which was worth $38.4 million at the end of the first quarter. On the second spot was Rubric Capital Management which amassed $37.1 million worth of shares. Moreover, Highbridge Capital Management, Highbridge Capital Management, and Citadel Investment Group were also bullish on Green Plains Inc. (NASDAQ:GPRE), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds have jumped into Green Plains Inc. (NASDAQ:GPRE) headfirst. Highbridge Capital Management, managed by Glenn Russell Dubin, created the most outsized call position in Green Plains Inc. (NASDAQ:GPRE). Highbridge Capital Management had $28.4 million invested in the company at the end of the quarter. David Greenspan’s Slate Path Capital also made a $10.2 million investment in the stock during the quarter. The following funds were also among the new GPRE investors: Till Bechtolsheimer’s Arosa Capital Management, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Green Plains Inc. (NASDAQ:GPRE) but similarly valued. These stocks are Golden Ocean Group Ltd (NASDAQ:GOGL), DXP Enterprises Inc (NASDAQ:DXPE), Re/Max Holdings Inc (NYSE:RMAX), and Virtus Investment Partners Inc (NASDAQ:VRTS). This group of stocks’ market values resemble GPRE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GOGL | 8 | 126531 | -1 |

| DXPE | 16 | 68795 | 4 |

| RMAX | 6 | 53016 | 1 |

| VRTS | 15 | 91759 | 4 |

| Average | 11.25 | 85025 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $162 million in GPRE’s case. DXP Enterprises Inc (NASDAQ:DXPE) is the most popular stock in this table. On the other hand Re/Max Holdings Inc (NYSE:RMAX) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Green Plains Inc. (NASDAQ:GPRE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately GPRE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GPRE were disappointed as the stock returned -20.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.