Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Graham Holdings Co (NYSE:GHC) changed recently.

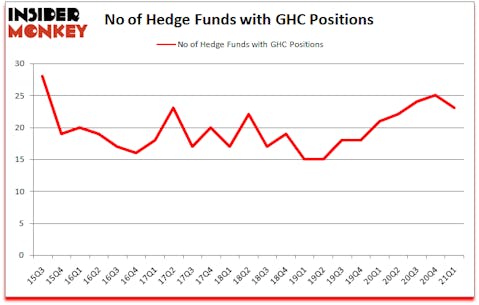

Is GHC a good stock to buy? Money managers were getting less bullish. The number of bullish hedge fund bets were trimmed by 2 lately. Graham Holdings Co (NYSE:GHC) was in 23 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 28. Our calculations also showed that GHC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). There were 25 hedge funds in our database with GHC holdings at the end of December.

In the eyes of most market participants, hedge funds are assumed to be worthless, old investment vehicles of yesteryear. While there are more than 8000 funds trading today, Our researchers choose to focus on the moguls of this club, approximately 850 funds. These investment experts handle the majority of the hedge fund industry’s total asset base, and by tracking their highest performing equity investments, Insider Monkey has identified several investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

Mason Hawkins of Southeastern Asset Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Chuck Schumer recently stated that marijuana legalization will be a Senate priority. So, we are checking out this under the radar stock that will benefit from this. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind let’s take a look at the key hedge fund action encompassing Graham Holdings Co (NYSE:GHC).

Do Hedge Funds Think GHC Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GHC over the last 23 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Graham Holdings Co (NYSE:GHC) was held by Southeastern Asset Management, which reported holding $117 million worth of stock at the end of December. It was followed by Wallace Capital Management with a $111.2 million position. Other investors bullish on the company included Wallace Capital Management, Madison Avenue Partners, and Renaissance Technologies. In terms of the portfolio weights assigned to each position Madison Avenue Partners allocated the biggest weight to Graham Holdings Co (NYSE:GHC), around 18.99% of its 13F portfolio. Wallace Capital Management is also relatively very bullish on the stock, setting aside 14.58 percent of its 13F equity portfolio to GHC.

Judging by the fact that Graham Holdings Co (NYSE:GHC) has witnessed falling interest from hedge fund managers, it’s safe to say that there were a few funds that decided to sell off their entire stakes in the first quarter. Interestingly, Chuck Royce’s Royce & Associates said goodbye to the biggest investment of the 750 funds monitored by Insider Monkey, totaling about $8.2 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $4.2 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 2 funds in the first quarter.

Let’s also examine hedge fund activity in other stocks similar to Graham Holdings Co (NYSE:GHC). These stocks are Hilltop Holdings Inc. (NYSE:HTH), Methanex Corporation (NASDAQ:MEOH), Micro Focus Intl PLC (NYSE:MFGP), JELD-WEN Holding, Inc. (NYSE:JELD), ZIM Integrated Shipping Services Ltd. (NYSE:ZIM), Magnolia Oil & Gas Corporation (NYSE:MGY), and LendingTree, Inc (NASDAQ:TREE). This group of stocks’ market valuations are similar to GHC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTH | 16 | 63331 | -4 |

| MEOH | 16 | 61332 | 4 |

| MFGP | 7 | 39325 | -3 |

| JELD | 27 | 290288 | 5 |

| ZIM | 14 | 199420 | 14 |

| MGY | 21 | 151925 | 0 |

| TREE | 25 | 568101 | -1 |

| Average | 18 | 196246 | 2.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $196 million. That figure was $551 million in GHC’s case. JELD-WEN Holding, Inc. (NYSE:JELD) is the most popular stock in this table. On the other hand Micro Focus Intl PLC (NYSE:MFGP) is the least popular one with only 7 bullish hedge fund positions. Graham Holdings Co (NYSE:GHC) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for GHC is 67.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. Hedge funds were also right about betting on GHC, though not to the same extent, as the stock returned 16.2% since Q1 (through July 16th) and outperformed the market as well.

Follow Graham Holdings Co (NYSE:GHC)

Follow Graham Holdings Co (NYSE:GHC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Defensive Stocks to Buy Now

- Ray Dalio’s Top 10 Stock Picks for 2021

- 10 Best TSX Stocks to Buy Right Now

Disclosure: None. This article was originally published at Insider Monkey.