The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 817 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30th, 2020. What do these smart investors think about W.R. Grace & Co. (NYSE:GRA)?

Is GRA a good stock to buy now? Hedge fund interest in W.R. Grace & Co. (NYSE:GRA) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that GRA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Shake Shack Inc (NYSE:SHAK), Cohen & Steers, Inc. (NYSE:CNS), and Workiva Inc (NYSE:WK) to gather more data points.

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 66 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Matthew Hulsizer of PEAK6 Capital

With all of this in mind we’re going to review the key hedge fund action encompassing W.R. Grace & Co. (NYSE:GRA).

Do Hedge Funds Think GRA Is A Good Stock To Buy Now?

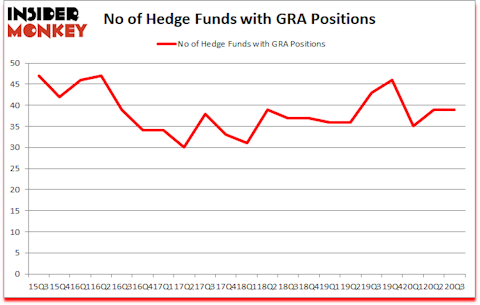

Heading into the fourth quarter of 2020, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 43 hedge funds with a bullish position in GRA a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, 40 North Management, managed by David S. Winter and David J. Millstone, holds the largest position in W.R. Grace & Co. (NYSE:GRA). 40 North Management has a $397.5 million position in the stock, comprising 16% of its 13F portfolio. The second most bullish fund manager is Soroban Capital Partners, led by Eric W. Mandelblatt and Gaurav Kapadia, holding a $110.1 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Other peers with similar optimism contain Ric Dillon’s Diamond Hill Capital, Andrew Wellington and Jeff Keswin’s Lyrical Asset Management and William von Mueffling’s Cantillon Capital Management. In terms of the portfolio weights assigned to each position 40 North Management allocated the biggest weight to W.R. Grace & Co. (NYSE:GRA), around 15.98% of its 13F portfolio. Atlantic Investment Management is also relatively very bullish on the stock, earmarking 10.92 percent of its 13F equity portfolio to GRA.

Since W.R. Grace & Co. (NYSE:GRA) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there was a specific group of money managers that elected to cut their entire stakes in the third quarter. Intriguingly, Phill Gross and Robert Atchinson’s Adage Capital Management dropped the biggest position of the “upper crust” of funds followed by Insider Monkey, comprising close to $46.5 million in stock, and Greg Poole’s Echo Street Capital Management was right behind this move, as the fund dumped about $16.9 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as W.R. Grace & Co. (NYSE:GRA) but similarly valued. These stocks are Shake Shack Inc (NYSE:SHAK), Cohen & Steers, Inc. (NYSE:CNS), Workiva Inc (NYSE:WK), Corporate Office Properties Trust (NYSE:OFC), Workhorse Group, Inc. (NASDAQ:WKHS), Evercore Inc. (NYSE:EVR), and Axsome Therapeutics, Inc. (NASDAQ:AXSM). This group of stocks’ market values are similar to GRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHAK | 26 | 521466 | 4 |

| CNS | 22 | 66119 | 1 |

| WK | 20 | 243844 | -1 |

| OFC | 21 | 192411 | 1 |

| WKHS | 13 | 105784 | 4 |

| EVR | 27 | 216500 | 2 |

| AXSM | 20 | 438563 | -11 |

| Average | 21.3 | 254955 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.3 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $976 million in GRA’s case. Evercore Inc. (NYSE:EVR) is the most popular stock in this table. On the other hand Workhorse Group, Inc. (NASDAQ:WKHS) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks W.R. Grace & Co. (NYSE:GRA) is more popular among hedge funds. Our overall hedge fund sentiment score for GRA is 79.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 33.3% in 2020 through December 18th but still managed to beat the market by 16.4 percentage points. Hedge funds were also right about betting on GRA as the stock returned 37.8% since the end of September (through 12/18) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow W R Grace & Co (NYSE:GRA)

Follow W R Grace & Co (NYSE:GRA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Autonomous Vehicle Stocks to Buy For 2021

- Barry Rosenstein and Jana Partners’ Top 10 Stock Picks

- Billionaire Larry Robbins’ Top Stock Picks

Disclosure: None. This article was originally published at Insider Monkey.