Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) in this article.

Hedge fund interest in Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Unity Bancorp, Inc. (NASDAQ:UNTY), Net 1 UEPS Technologies Inc (NASDAQ:UEPS), and PICO Holdings Inc (NASDAQ:PICO) to gather more data points.

In the financial world there are a multitude of metrics market participants have at their disposal to analyze publicly traded companies. Some of the most innovative metrics are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can outperform the broader indices by a solid margin (see the details here).

We’re going to take a peek at the fresh hedge fund action surrounding Foamix Pharmaceuticals Ltd (NASDAQ:FOMX).

What does smart money think about Foamix Pharmaceuticals Ltd (NASDAQ:FOMX)?

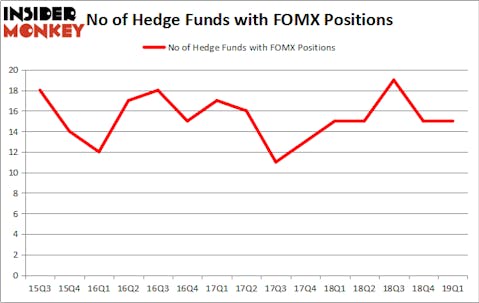

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 15 hedge funds with a bullish position in FOMX a year ago. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, OrbiMed Advisors held the most valuable stake in Foamix Pharmaceuticals Ltd (NASDAQ:FOMX), which was worth $19.5 million at the end of the first quarter. On the second spot was Perceptive Advisors which amassed $17.5 million worth of shares. Moreover, Great Point Partners, Sio Capital, and DAFNA Capital Management were also bullish on Foamix Pharmaceuticals Ltd (NASDAQ:FOMX), allocating a large percentage of their portfolios to this stock.

Seeing as Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies who were dropping their entire stakes by the end of the third quarter. It’s worth mentioning that David Lohman’s Diag Capital cut the biggest investment of all the hedgies tracked by Insider Monkey, worth close to $1 million in stock, and Albert Cha and Frank Kung’s Vivo Capital was right behind this move, as the fund sold off about $0.7 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) but similarly valued. These stocks are Unity Bancorp, Inc. (NASDAQ:UNTY), Net 1 UEPS Technologies Inc (NASDAQ:UEPS), PICO Holdings Inc (NASDAQ:PICO), and Alico, Inc. (NASDAQ:ALCO). All of these stocks’ market caps are closest to FOMX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UNTY | 4 | 29798 | 0 |

| UEPS | 10 | 68145 | -3 |

| PICO | 7 | 24519 | -1 |

| ALCO | 6 | 24100 | 0 |

| Average | 6.75 | 36641 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.75 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $67 million in FOMX’s case. Net 1 UEPS Technologies Inc (NASDAQ:UEPS) is the most popular stock in this table. On the other hand Unity Bancorp, Inc. (NASDAQ:UNTY) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Foamix Pharmaceuticals Ltd (NASDAQ:FOMX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FOMX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FOMX were disappointed as the stock returned -28.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.