Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Five Prime Therapeutics Inc (NASDAQ:FPRX)? The smart money sentiment can provide an answer to this question.

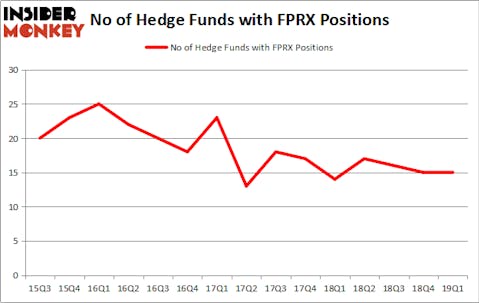

Five Prime Therapeutics Inc (NASDAQ:FPRX) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. At the end of this article we will also compare FPRX to other stocks including Arrow Financial Corporation (NASDAQ:AROW), Krystal Biotech, Inc. (NASDAQ:KRYS), and Axsome Therapeutics, Inc. (NASDAQ:AXSM) to get a better sense of its popularity.

Today there are a multitude of signals shareholders use to evaluate stocks. Two of the most under-the-radar signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the best picks of the elite investment managers can outpace the broader indices by a superb margin (see the details here).

Let’s check out the key hedge fund action encompassing Five Prime Therapeutics Inc (NASDAQ:FPRX).

What have hedge funds been doing with Five Prime Therapeutics Inc (NASDAQ:FPRX)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 14 hedge funds with a bullish position in FPRX a year ago. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

The largest stake in Five Prime Therapeutics Inc (NASDAQ:FPRX) was held by Biotechnology Value Fund / BVF Inc, which reported holding $41.1 million worth of stock at the end of March. It was followed by Great Point Partners with a $32.1 million position. Other investors bullish on the company included Adage Capital Management, Renaissance Technologies, and GLG Partners.

Judging by the fact that Five Prime Therapeutics Inc (NASDAQ:FPRX) has experienced a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of hedge funds that slashed their entire stakes by the end of the third quarter. At the top of the heap, Oleg Nodelman’s EcoR1 Capital dropped the biggest stake of the “upper crust” of funds watched by Insider Monkey, worth an estimated $3 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund dumped about $1.8 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Five Prime Therapeutics Inc (NASDAQ:FPRX). We will take a look at Arrow Financial Corporation (NASDAQ:AROW), Krystal Biotech, Inc. (NASDAQ:KRYS), Axsome Therapeutics, Inc. (NASDAQ:AXSM), and Mitek Systems, Inc. (NASDAQ:MITK). All of these stocks’ market caps are similar to FPRX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AROW | 2 | 11697 | -1 |

| KRYS | 16 | 113063 | 4 |

| AXSM | 14 | 92771 | 8 |

| MITK | 21 | 56038 | 6 |

| Average | 13.25 | 68392 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $126 million in FPRX’s case. Mitek Systems, Inc. (NASDAQ:MITK) is the most popular stock in this table. On the other hand Arrow Financial Corporation (NASDAQ:AROW) is the least popular one with only 2 bullish hedge fund positions. Five Prime Therapeutics Inc (NASDAQ:FPRX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FPRX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FPRX were disappointed as the stock returned -51.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.