At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

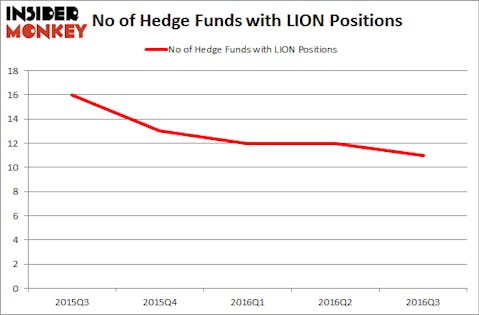

Is Fidelity Southern Corporation (NASDAQ:LION) a buy here? The best stock pickers are indeed reducing their bets on the stock. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings retreated by 1 in recent months. There were 12 hedge funds in our database with LION positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Extreme Networks, Inc (NASDAQ:EXTR), Alpine Global Premier Properties Fund (NYSE:AWP), and Carrols Restaurant Group, Inc. (NASDAQ:TAST) to gather more data points.

Follow Fidelity Southern Corp (NASDAQ:LION)

Follow Fidelity Southern Corp (NASDAQ:LION)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Kevin George/Shutterstock.com

Now, we’re going to take a look at the key action surrounding Fidelity Southern Corporation (NASDAQ:LION).

How are hedge funds trading Fidelity Southern Corporation (NASDAQ:LION)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a loss of 8% from the second quarter of 2016. By comparison, 13 hedge funds held shares or bullish call options in LION heading into this year. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, EJF Capital, led by Emanuel J. Friedman, holds the most valuable position in Fidelity Southern Corporation (NASDAQ:LION). EJF Capital has a $18.4 million position in the stock, comprising 1.5% of its 13F portfolio. Coming in second is Renaissance Technologies, one of the largest hedge funds in the world, which holds a $6.3 million position. Other professional money managers with similar optimism comprise Chuck Royce’s Royce & Associates, Matthew Lindenbaum’s Basswood Capital and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.