We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Fiat Chrysler Automobiles NV (NYSE:FCAU).

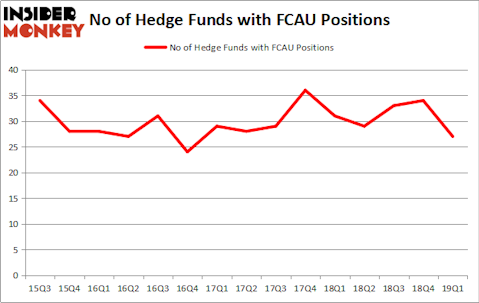

Is Fiat Chrysler Automobiles NV (NYSE:FCAU) a buy here? Hedge funds are taking a bearish view. The number of long hedge fund positions fell by 7 recently. Our calculations also showed that FCAU isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are seen as unimportant, outdated investment vehicles of yesteryear. While there are over 8000 funds with their doors open at present, Our researchers hone in on the leaders of this group, approximately 750 funds. These investment experts shepherd the majority of all hedge funds’ total asset base, and by tailing their first-class picks, Insider Monkey has come up with many investment strategies that have historically outstripped the market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to check out the new hedge fund action regarding Fiat Chrysler Automobiles NV (NYSE:FCAU).

Hedge fund activity in Fiat Chrysler Automobiles NV (NYSE:FCAU)

At Q1’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the fourth quarter of 2018. By comparison, 31 hedge funds held shares or bullish call options in FCAU a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chase Coleman’s Tiger Global Management has the largest position in Fiat Chrysler Automobiles NV (NYSE:FCAU), worth close to $1.3112 billion, comprising 7.2% of its total 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $333.7 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish comprise Mohnish Pabrai’s Mohnish Pabrai, John Overdeck and David Siegel’s Two Sigma Advisors and Wilmot B. Harkey and Daniel Mack’s Nantahala Capital Management.

Judging by the fact that Fiat Chrysler Automobiles NV (NYSE:FCAU) has experienced bearish sentiment from hedge fund managers, logic holds that there is a sect of money managers that slashed their entire stakes heading into Q3. It’s worth mentioning that Glenn Russell Dubin’s Highbridge Capital Management said goodbye to the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth close to $54.1 million in call options, and Glenn Russell Dubin’s Highbridge Capital Management was right behind this move, as the fund said goodbye to about $44.8 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 7 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Fiat Chrysler Automobiles NV (NYSE:FCAU). These stocks are Sprint Corporation (NYSE:S), Motorola Solutions Inc (NYSE:MSI), Mercadolibre Inc (NASDAQ:MELI), and Sun Life Financial Inc. (NYSE:SLF). This group of stocks’ market caps match FCAU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| S | 24 | 618801 | 0 |

| MSI | 29 | 835065 | 6 |

| MELI | 41 | 2802210 | 10 |

| SLF | 11 | 103048 | 1 |

| Average | 26.25 | 1089781 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $1090 million. That figure was $2247 million in FCAU’s case. Mercadolibre Inc (NASDAQ:MELI) is the most popular stock in this table. On the other hand Sun Life Financial Inc. (NYSE:SLF) is the least popular one with only 11 bullish hedge fund positions. Fiat Chrysler Automobiles NV (NYSE:FCAU) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on FCAU as the stock returned 4.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.