Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by 4 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Federal Agricultural Mortgage Corp. (NYSE:AGM) from the perspective of those elite funds.

Federal Agricultural Mortgage Corp. (NYSE:AGM) investors should be aware of a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that AGM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are assumed to be unimportant, old financial tools of yesteryear. While there are greater than 8000 funds trading today, Our researchers hone in on the elite of this club, approximately 750 funds. These money managers oversee bulk of the smart money’s total capital, and by observing their highest performing picks, Insider Monkey has revealed several investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. Now we’re going to take a gander at the latest hedge fund action surrounding Federal Agricultural Mortgage Corp. (NYSE:AGM).

How have hedgies been trading Federal Agricultural Mortgage Corp. (NYSE:AGM)?

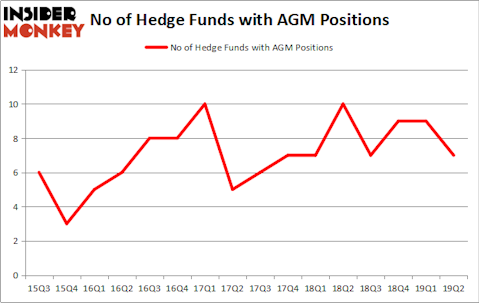

Heading into the third quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -22% from the first quarter of 2019. On the other hand, there were a total of 10 hedge funds with a bullish position in AGM a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

The largest stake in Federal Agricultural Mortgage Corp. (NYSE:AGM) was held by Renaissance Technologies, which reported holding $19 million worth of stock at the end of March. It was followed by Millennium Management with a $3.4 million position. Other investors bullish on the company included Arrowstreet Capital, Citadel Investment Group, and AQR Capital Management.

Seeing as Federal Agricultural Mortgage Corp. (NYSE:AGM) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there were a few hedgies that slashed their positions entirely heading into Q3. At the top of the heap, Jeffrey Talpins’s Element Capital Management sold off the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $0.3 million in stock. Paul Marshall and Ian Wace’s fund, Marshall Wace LLP, also sold off its stock, about $0 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Federal Agricultural Mortgage Corp. (NYSE:AGM) but similarly valued. We will take a look at C&J Energy Services, Inc (NYSE:CJ), Mallinckrodt Public Limited Company (NYSE:MNK), Omega Flex, Inc. (NASDAQ:OFLX), and Community Healthcare Trust Inc (NYSE:CHCT). This group of stocks’ market valuations resemble AGM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CJ | 21 | 154618 | -4 |

| MNK | 20 | 152724 | 0 |

| OFLX | 3 | 9894 | -1 |

| CHCT | 8 | 81504 | -1 |

| Average | 13 | 99685 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $30 million in AGM’s case. C&J Energy Services, Inc (NYSE:CJ) is the most popular stock in this table. On the other hand Omega Flex, Inc. (NASDAQ:OFLX) is the least popular one with only 3 bullish hedge fund positions. Federal Agricultural Mortgage Corp. (NYSE:AGM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on AGM as the stock returned 13.3% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.