“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

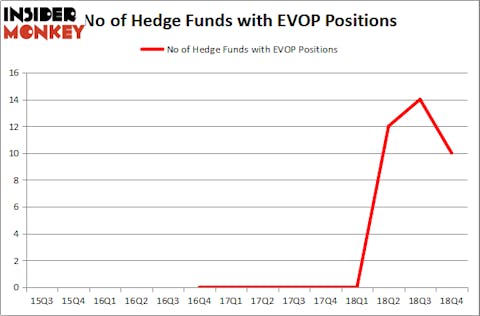

EVO Payments, Inc. (NASDAQ:EVOP) has seen a decrease in enthusiasm from smart money of late. Our calculations also showed that EVOP isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are a multitude of formulas stock market investors put to use to assess their holdings. Two of the less utilized formulas are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the elite money managers can outperform the S&P 500 by a very impressive amount (see the details here).

Let’s take a gander at the key hedge fund action surrounding EVO Payments, Inc. (NASDAQ:EVOP).

What have hedge funds been doing with EVO Payments, Inc. (NASDAQ:EVOP)?

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -29% from the second quarter of 2018. By comparison, 0 hedge funds held shares or bullish call options in EVOP a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Select Equity Group, managed by Robert Joseph Caruso, holds the biggest position in EVO Payments, Inc. (NASDAQ:EVOP). Select Equity Group has a $15.4 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Greenhouse Funds, led by Joe Milano, holding a $11.9 million position; the fund has 2.9% of its 13F portfolio invested in the stock. Other professional money managers that are bullish contain Phill Gross and Robert Atchinson’s Adage Capital Management, Richard Driehaus’s Driehaus Capital and Benjamin A. Smith’s Laurion Capital Management.

Because EVO Payments, Inc. (NASDAQ:EVOP) has faced falling interest from the entirety of the hedge funds we track, it’s safe to say that there lies a certain “tier” of hedgies who were dropping their positions entirely last quarter. Intriguingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dropped the biggest position of all the hedgies followed by Insider Monkey, totaling an estimated $6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also cut its stock, about $1.2 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to EVO Payments, Inc. (NASDAQ:EVOP). These stocks are Jack in the Box Inc. (NASDAQ:JACK), Central Garden & Pet Co (NASDAQ:CENT), BioTelemetry, Inc. (NASDAQ:BEAT), and Crestwood Equity Partners LP (NYSE:CEQP). This group of stocks’ market valuations are closest to EVOP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JACK | 29 | 624500 | 3 |

| CENT | 24 | 147833 | 4 |

| BEAT | 24 | 75826 | 8 |

| CEQP | 3 | 25732 | -1 |

| Average | 20 | 218473 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $218 million. That figure was $46 million in EVOP’s case. Jack in the Box Inc. (NASDAQ:JACK) is the most popular stock in this table. On the other hand Crestwood Equity Partners LP (NYSE:CEQP) is the least popular one with only 3 bullish hedge fund positions. EVO Payments, Inc. (NASDAQ:EVOP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately EVOP wasn’t nearly as popular as these 15 stock (hedge fund sentiment was quite bearish); EVOP investors were disappointed as the stock returned 14.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.