Is Equity Residential (NYSE:EQR) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

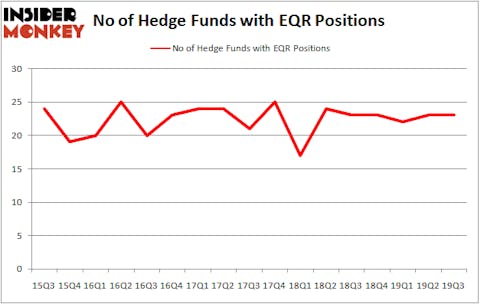

Equity Residential (NYSE:EQR) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 23 hedge funds’ portfolios at the end of September. At the end of this article we will also compare EQR to other stocks including Advanced Micro Devices, Inc. (NASDAQ:AMD), Twitter Inc (NYSE:TWTR), and Barclays PLC (NYSE:BCS) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most market participants, hedge funds are viewed as worthless, outdated financial vehicles of years past. While there are greater than 8000 funds trading today, Our researchers hone in on the top tier of this club, about 750 funds. These investment experts handle the lion’s share of all hedge funds’ total asset base, and by watching their finest investments, Insider Monkey has brought to light numerous investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to go over the new hedge fund action regarding Equity Residential (NYSE:EQR).

What have hedge funds been doing with Equity Residential (NYSE:EQR)?

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2019. Below, you can check out the change in hedge fund sentiment towards EQR over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Equity Residential (NYSE:EQR), which was worth $56.5 million at the end of the third quarter. On the second spot was Adage Capital Management which amassed $29.2 million worth of shares. Citadel Investment Group, Millennium Management, and D E Shaw were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Land & Buildings Investment Management allocated the biggest weight to Equity Residential (NYSE:EQR), around 3.01% of its 13F portfolio. Gillson Capital is also relatively very bullish on the stock, earmarking 0.59 percent of its 13F equity portfolio to EQR.

Judging by the fact that Equity Residential (NYSE:EQR) has experienced bearish sentiment from the entirety of the hedge funds we track, logic holds that there were a few fund managers that slashed their positions entirely heading into Q4. It’s worth mentioning that Greg Poole’s Echo Street Capital Management said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, worth close to $13.8 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also dumped its stock, about $2.3 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Equity Residential (NYSE:EQR). We will take a look at Advanced Micro Devices, Inc. (NASDAQ:AMD), Twitter Inc (NYSE:TWTR), Barclays PLC (NYSE:BCS), and Canadian Natural Resources Limited (NYSE:CNQ). This group of stocks’ market caps match EQR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMD | 56 | 1135132 | 15 |

| TWTR | 50 | 2252822 | 3 |

| BCS | 15 | 131768 | 3 |

| CNQ | 32 | 558227 | 8 |

| Average | 38.25 | 1019487 | 7.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.25 hedge funds with bullish positions and the average amount invested in these stocks was $1019 million. That figure was $196 million in EQR’s case. Advanced Micro Devices, Inc. (NASDAQ:AMD) is the most popular stock in this table. On the other hand Barclays PLC (NYSE:BCS) is the least popular one with only 15 bullish hedge fund positions. Equity Residential (NYSE:EQR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately EQR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); EQR investors were disappointed as the stock returned -1.3% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.