Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the third quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of Embraer SA (NYSE:ERJ) based on that data.

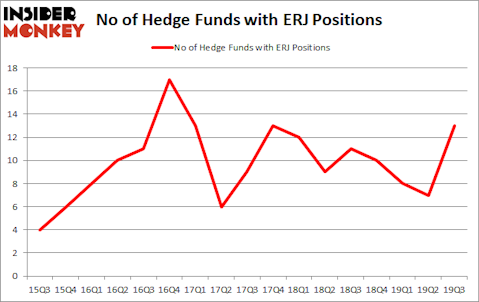

Is Embraer SA (NYSE:ERJ) a great investment today? The best stock pickers are in a bullish mood. The number of bullish hedge fund positions inched up by 6 in recent months. Our calculations also showed that ERJ isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are dozens of tools stock traders use to assess their holdings. A pair of the best tools are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass their index-focused peers by a superb margin (see the details here).

Israel Englander of Millennium Management

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the new hedge fund action regarding Embraer SA (NYSE:ERJ).

Hedge fund activity in Embraer SA (NYSE:ERJ)

At the end of the third quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 86% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in ERJ a year ago. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Israel Englander’s Millennium Management has the number one position in Embraer SA (NYSE:ERJ), worth close to $23.1 million, accounting for less than 0.1%% of its total 13F portfolio. The second largest stake is held by Renaissance Technologies, which holds a $22.2 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish consist of Cliff Asness’s AQR Capital Management, Steve Cohen’s Point72 Asset Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Stevens Capital Management allocated the biggest weight to Embraer SA (NYSE:ERJ), around 0.07% of its 13F portfolio. Point72 Asset Management is also relatively very bullish on the stock, designating 0.05 percent of its 13F equity portfolio to ERJ.

Consequently, specific money managers were leading the bulls’ herd. Point72 Asset Management, managed by Steve Cohen, assembled the most valuable position in Embraer SA (NYSE:ERJ). Point72 Asset Management had $8.3 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $6.2 million investment in the stock during the quarter. The other funds with brand new ERJ positions are David E. Shaw’s D E Shaw, Michael Gelband’s ExodusPoint Capital, and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Embraer SA (NYSE:ERJ) but similarly valued. These stocks are UMB Financial Corporation (NASDAQ:UMBF), Sinopec Shanghai Petrochemical Co. (NYSE:SHI), Home Bancshares Inc (NASDAQ:HOMB), and John Bean Technologies Corporation (NYSE:JBT). This group of stocks’ market caps are closest to ERJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UMBF | 14 | 77629 | -2 |

| SHI | 3 | 13063 | -2 |

| HOMB | 11 | 12529 | -2 |

| JBT | 14 | 102280 | 4 |

| Average | 10.5 | 51375 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $51 million. That figure was $77 million in ERJ’s case. UMB Financial Corporation (NASDAQ:UMBF) is the most popular stock in this table. On the other hand Sinopec Shanghai Petrochemical Co. (NYSE:SHI) is the least popular one with only 3 bullish hedge fund positions. Embraer SA (NYSE:ERJ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately ERJ wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on ERJ were disappointed as the stock returned -1.3% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.