Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 900 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about New Oriental Education & Technology Group Inc. (NYSE:EDU) in this article.

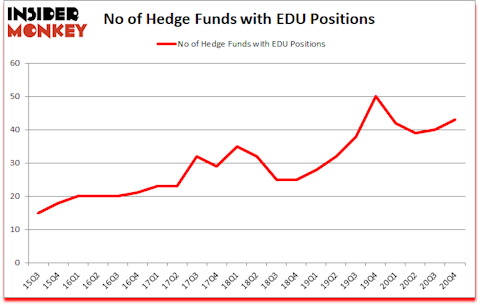

Is EDU stock a buy or sell? New Oriental Education & Technology Group Inc. (NYSE:EDU) shareholders have witnessed an increase in hedge fund interest lately. New Oriental Education & Technology Group Inc. (NYSE:EDU) was in 43 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 50. Our calculations also showed that EDU isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In today’s marketplace there are tons of signals stock market investors put to use to evaluate their stock investments. A couple of the most underrated signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top money managers can outpace the market by a solid margin (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Keeping this in mind we’re going to go over the new hedge fund action regarding New Oriental Education & Technology Group Inc. (NYSE:EDU).

Do Hedge Funds Think EDU Is A Good Stock To Buy Now?

At fourth quarter’s end, a total of 43 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the third quarter of 2020. The graph below displays the number of hedge funds with bullish position in EDU over the last 22 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

More specifically, Alkeon Capital Management was the largest shareholder of New Oriental Education & Technology Group Inc. (NYSE:EDU), with a stake worth $353.2 million reported as of the end of December. Trailing Alkeon Capital Management was Tiger Global Management LLC, which amassed a stake valued at $342.5 million. GQG Partners, Renaissance Technologies, and Farallon Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position IvyRock Asset Management allocated the biggest weight to New Oriental Education & Technology Group Inc. (NYSE:EDU), around 29.29% of its 13F portfolio. Serenity Capital is also relatively very bullish on the stock, dishing out 28.67 percent of its 13F equity portfolio to EDU.

With a general bullishness amongst the heavyweights, specific money managers have jumped into New Oriental Education & Technology Group Inc. (NYSE:EDU) headfirst. D1 Capital Partners, managed by Daniel Sundheim, initiated the most valuable position in New Oriental Education & Technology Group Inc. (NYSE:EDU). D1 Capital Partners had $74.3 million invested in the company at the end of the quarter. Charles Huang’s IvyRock Asset Management also made a $47.6 million investment in the stock during the quarter. The following funds were also among the new EDU investors: Richard Driehaus’s Driehaus Capital, Kevin Mok’s Hidden Lake Asset Management, and Run Ye, Junji Takegami and Hoyon Hwang’s Tiger Pacific Capital.

Let’s go over hedge fund activity in other stocks similar to New Oriental Education & Technology Group Inc. (NYSE:EDU). We will take a look at Seagen Inc. (NASDAQ:SGEN), SBA Communications Corporation (NASDAQ:SBAC), Royalty Pharma Plc (NASDAQ:RPRX), ANSYS, Inc. (NASDAQ:ANSS), AFLAC Incorporated (NYSE:AFL), Credit Suisse Group AG (NYSE:CS), and Kinder Morgan Inc (NYSE:KMI). This group of stocks’ market caps match EDU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SGEN | 32 | 8619222 | 4 |

| SBAC | 43 | 1761954 | 0 |

| RPRX | 18 | 3384693 | -2 |

| ANSS | 40 | 1633274 | 0 |

| AFL | 35 | 389034 | 1 |

| CS | 11 | 46020 | -2 |

| KMI | 42 | 1031459 | -4 |

| Average | 31.6 | 2409379 | -0.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.6 hedge funds with bullish positions and the average amount invested in these stocks was $2409 million. That figure was $2541 million in EDU’s case. SBA Communications Corporation (NASDAQ:SBAC) is the most popular stock in this table. On the other hand Credit Suisse Group AG (NYSE:CS) is the least popular one with only 11 bullish hedge fund positions. New Oriental Education & Technology Group Inc. (NYSE:EDU) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EDU is 83.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and beat the market again by 0.8 percentage points. Unfortunately EDU wasn’t nearly as popular as these 30 stocks and hedge funds that were betting on EDU were disappointed as the stock returned -11.4% since the end of December (through 3/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 30 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Follow New Oriental Education & Technology Group Inc. (NYSE:EDU)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.