Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

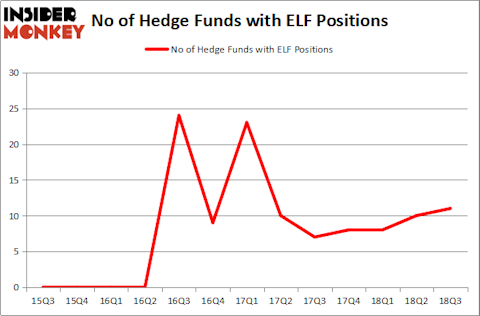

Is e.l.f. Beauty, Inc. (NYSE:ELF) ready to rally soon? Money managers are becoming hopeful. The number of long hedge fund positions rose by 1 in recent months. Our calculations also showed that ELF isn’t among the 30 most popular stocks among hedge funds. ELF was in 11 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with ELF holdings at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the fresh hedge fund action regarding e.l.f. Beauty, Inc. (NYSE:ELF).

What have hedge funds been doing with e.l.f. Beauty, Inc. (NYSE:ELF)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ELF over the last 13 quarters. With the smart money’s capital changing hands, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Marathon Partners was the largest shareholder of e.l.f. Beauty, Inc. (NYSE:ELF), with a stake worth $51.6 million reported as of the end of September. Trailing Marathon Partners was Bares Capital Management, which amassed a stake valued at $37.4 million. Portolan Capital Management, D E Shaw, and PDT Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, key hedge funds were leading the bulls’ herd. Portolan Capital Management, managed by George McCabe, created the biggest position in e.l.f. Beauty, Inc. (NYSE:ELF). Portolan Capital Management had $12.2 million invested in the company at the end of the quarter. Peter Muller’s PDT Partners also initiated a $1.3 million position during the quarter. The following funds were also among the new ELF investors: Paul Marshall and Ian Wace’s Marshall Wace LLP and Noam Gottesman’s GLG Partners.

Let’s check out hedge fund activity in other stocks similar to e.l.f. Beauty, Inc. (NYSE:ELF). These stocks are Impinj, Inc. (NASDAQ:PI), The India Fund, Inc. (NYSE:IFN), i3 Verticals, Inc. (NASDAQ:IIIV), and Retail Value Inc. (NYSE:RVI). This group of stocks’ market caps resemble ELF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PI | 9 | 149084 | 3 |

| IFN | 1 | 74 | 0 |

| IIIV | 12 | 45163 | 1 |

| RVI | 16 | 162222 | 15 |

| Average | 9.5 | 89136 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.5 hedge funds with bullish positions and the average amount invested in these stocks was $89 million. That figure was $107 million in ELF’s case. Retail Value Inc. (NYSE:RVI) is the most popular stock in this table. On the other hand The India Fund, Inc. (NYSE:IFN) is the least popular one with only 1 bullish hedge fund positions. e.l.f. Beauty, Inc. (NYSE:ELF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RVI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.