You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

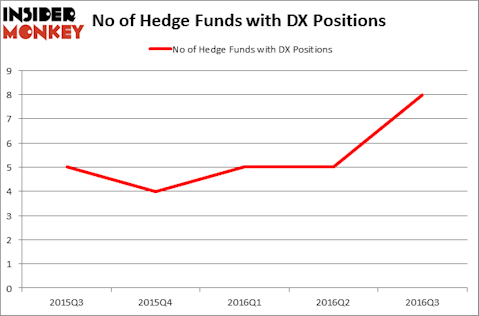

Is Dynex Capital Inc (NYSE:DX) ready to rally soon? Money managers are actually buying. The number of long hedge fund bets that are revealed through the 13F filings rose by 3 lately. DX was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. There were 5 hedge funds in our database with DX positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Landec Corporation (NASDAQ:LNDC), Habit Restaurants Inc (NASDAQ:HABT), and Johnson Outdoors Inc. (NASDAQ:JOUT) to gather more data points.

Follow Dynex Capital Inc (NYSE:DX)

Follow Dynex Capital Inc (NYSE:DX)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

YURALAITS ALBERT/Shutterstock.com

Now, we’re going to take a glance at the key action regarding Dynex Capital Inc (NYSE:DX).

How are hedge funds trading Dynex Capital Inc (NYSE:DX)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 60% from the second quarter of 2016. On the other hand, there were a total of 4 hedge funds with a bullish position in DX at the beginning of this year. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, holds the most valuable position in Dynex Capital Inc (NYSE:DX). Arrowstreet Capital has a $3.7 million position in the stock, comprising less than 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $2 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions include Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, some big names have been driving this bullishness. Renaissance Technologies, one of the largest hedge funds in the world, assembled the largest position in Dynex Capital Inc (NYSE:DX). Renaissance Technologies had $1.6 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $0.3 million position during the quarter. The only other fund with a brand new DX position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now review hedge fund activity in other stocks similar to Dynex Capital Inc (NYSE:DX). These stocks are Landec Corporation (NASDAQ:LNDC), Habit Restaurants Inc (NASDAQ:HABT), Johnson Outdoors Inc. (NASDAQ:JOUT), and Horizon Global Corp (NYSE:HZN). All of these stocks’ market caps are similar to DX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNDC | 6 | 66086 | 0 |

| HABT | 13 | 41765 | -1 |

| JOUT | 6 | 11001 | 2 |

| HZN | 19 | 73027 | 6 |

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $9 million in DX’s case. Horizon Global Corp (NYSE:HZN) is the most popular stock in this table. On the other hand Landec Corporation (NASDAQ:LNDC) is the least popular one with only 6 bullish hedge fund positions. Dynex Capital Inc (NYSE:DX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard HZN might be a better candidate to consider taking a long position in.