On September 2, DVAX fell over 32% after the FDA canceled the advisory committee meeting for November, saying it needed time to review and resolve several outstanding issues. On October 3, DVAX disclosed that it had received the FDA’s requests for more information to settle those outstanding issues, and that the company is working to resolve the requests fully before the PDUFA date of December 15.

Given that 13 of the past 15 canceled advisory committee meetings have been rejected, some pundits such as TheStreet’s Adam Feuerstein are cautious/bearish. With the price action, the market has agreed more with the bearish side.

Now, let’s go over the fresh action encompassing Dynavax Technologies Corporation (NASDAQ:DVAX).

What does the smart money think about Dynavax Technologies Corporation (NASDAQ:DVAX)?

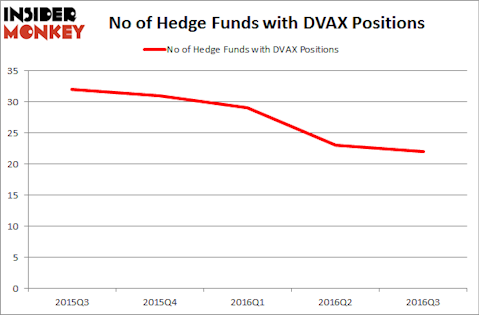

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards DVAX over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Steve Cohen’s Point72 Asset Management has the biggest position in Dynavax Technologies Corporation (NASDAQ:DVAX), worth close to $18.4 million, corresponding to 0.1% of its total 13F portfolio. The second largest stake is held by Rima Senvest Management, led by Richard Mashaal, which holds a $15.1 million position; 1.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism contain Kevin Kotler’s Broadfin Capital, and Hal Mintz’s Sabby Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that sold off their entire stakes in the stock during the third quarter. It’s worth mentioning that Samuel Isaly’s OrbiMed Advisors sold off the biggest investment of all the investors monitored by Insider Monkey, comprising an estimated $35 million in stock, and Bihua Chen’s Cormorant Asset Management was right behind this move, as the fund dumped about $9.3 million worth of shares.

Let’s now review hedge fund activity in other stocks similar to Dynavax Technologies Corporation (NASDAQ:DVAX). We will take a look at BioTime, Inc. (NYSEAMEX:BTX), Teligent Inc (NASDAQ:TLGT), Gold Resource Corporation (NYSEAMEX:GORO), and Neuroderm Ltd (NASDAQ:NDRM). This group of stocks’ market caps match DVAX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTX | 7 | 102369 | 1 |

| TLGT | 7 | 31292 | 0 |

| GORO | 6 | 17219 | -1 |

| NDRM | 16 | 120648 | 2 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $131 million in DVAX’s case. Neuroderm Ltd (NASDAQ:NDRM) is the most popular stock in this table. On the other hand Gold Resource Corporation (NYSEAMEX:GORO) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Dynavax Technologies Corporation (NASDAQ:DVAX) is more popular among hedge funds.

As it stands right now, DVAX is a high risk/high reward name. If the FDA rejects the drug, DVAX shares could fall sharply. Given analysts’ estimates of $600-$750 million in peak revenues, a standard 4x peak sales valuation also gives Dynavax substantial upside if HEPLISAV-B is approved.