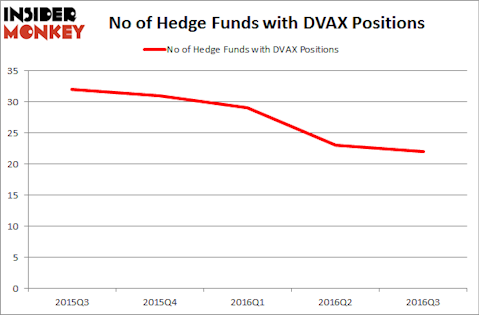

Is Dynavax Technologies Corporation (NASDAQ:DVAX) a good stock to buy? Investors who are in the know are altogether becoming less confident. The number of bullish hedge fund positions that are disclosed in regulatory 13F filings were cut by 1 recently. There were 23 hedge funds in our database with DVAX holdings at the end of the previous quarter. At the end of this article we will also compare DVAX to other stocks including BioTime, Inc. (NYSEAMEX:BTX), Teligent Inc (NASDAQ:TLGT), and Gold Resource Corporation (NYSEAMEX:GORO) to get a better sense of its popularity though.

Follow Dynavax Technologies Corp (NASDAQ:DVAX)

Follow Dynavax Technologies Corp (NASDAQ:DVAX)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Dynavax (DVAX)’s lead product candidate is HEPLISAV-B, an investigational vaccine for adult hepatitis B. Hepatitis B is a serious condition that can lead to cirrhosis, hepatocellular carcinoma, and chronic hepatic insufficiency. Around 350 million people globally are chronically infected with Hepatitis B and are carriers of the virus.

Elena Pavlovich/Shutterstock.com

Currently, there are two vaccines for Hepatitis B on the market, Engerix-B by GlaxoSmithKline, and Recombivax HB from Merck. Both vaccines require three shots, the first two shots one month apart, and the third shot six months after the first. Because of the long waiting period for the third shot, many patients don’t take it and don’t receive the full protection of the vaccine. If approved, Dynavax’s HEPLISAV-B would be superior than the two vaccines on the market because it requires only two shots one month apart before becoming fully effective. On June 11, DVAX presented efficacy data from a Phase 3 trial demonstrating that HEPLISAV-B provided a higher rate of seroprotection than Engerix-B in adults with type 2 diabetes. Because of the greater seroprotection and shorter times, analyst believe HEPLISAV-B will garner a substantial percentage of the estimated $1 billion-a-year market.

Dynavax previously applied for a Biologics License Application (BLA) for HEPLISAV-B in 2012, but didn’t get approval because the FDA wanted more safety data. In 2014, Dynavax began new safety studies to produce the additional data the FDA requested and on January 7 2016, Dynavax released positive results from a Phase 3 study that showed that HEPLISAV-B had met the primary endpoint with respect to the overall safety of the drug. In late March 2016, the FDA accepted for review the BLA for HEPLISAV-B.

On April 27 2016, DVAX fell substantially after the FDA said it needed more time to review the BLA for HEPLISAV-B. The FDA determined that the integrated data Dynavax submitted represented a major amendment to the BLA, and the agency postponed the PDUFA date for HEPLISAV-B by three months to December 15, 2016. The FDA also set the Advisory Committee meeting to occur on November 16.

On September 2, DVAX fell over 32% after the FDA canceled the advisory committee meeting for November, saying it needed time to review and resolve several outstanding issues. On October 3, DVAX disclosed that it had received the FDA’s requests for more information to settle those outstanding issues, and that the company is working to resolve the requests fully before the PDUFA date of December 15.

Given that 13 of the past 15 canceled advisory committee meetings have been rejected, some pundits such as TheStreet’s Adam Feuerstein are cautious/bearish. With the price action, the market has agreed more with the bearish side.

Now, let’s go over the fresh action encompassing Dynavax Technologies Corporation (NASDAQ:DVAX).

What does the smart money think about Dynavax Technologies Corporation (NASDAQ:DVAX)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards DVAX over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Steve Cohen’s Point72 Asset Management has the biggest position in Dynavax Technologies Corporation (NASDAQ:DVAX), worth close to $18.4 million, corresponding to 0.1% of its total 13F portfolio. The second largest stake is held by Rima Senvest Management, led by Richard Mashaal, which holds a $15.1 million position; 1.1% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors with similar optimism contain Kevin Kotler’s Broadfin Capital, and Hal Mintz’s Sabby Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that sold off their entire stakes in the stock during the third quarter. It’s worth mentioning that Samuel Isaly’s OrbiMed Advisors sold off the biggest investment of all the investors monitored by Insider Monkey, comprising an estimated $35 million in stock, and Bihua Chen’s Cormorant Asset Management was right behind this move, as the fund dumped about $9.3 million worth of shares.

Let’s now review hedge fund activity in other stocks similar to Dynavax Technologies Corporation (NASDAQ:DVAX). We will take a look at BioTime, Inc. (NYSEAMEX:BTX), Teligent Inc (NASDAQ:TLGT), Gold Resource Corporation (NYSEAMEX:GORO), and Neuroderm Ltd (NASDAQ:NDRM). This group of stocks’ market caps match DVAX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BTX | 7 | 102369 | 1 |

| TLGT | 7 | 31292 | 0 |

| GORO | 6 | 17219 | -1 |

| NDRM | 16 | 120648 | 2 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $68 million. That figure was $131 million in DVAX’s case. Neuroderm Ltd (NASDAQ:NDRM) is the most popular stock in this table. On the other hand Gold Resource Corporation (NYSEAMEX:GORO) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Dynavax Technologies Corporation (NASDAQ:DVAX) is more popular among hedge funds.

As it stands right now, DVAX is a high risk/high reward name. If the FDA rejects the drug, DVAX shares could fall sharply. Given analysts’ estimates of $600-$750 million in peak revenues, a standard 4x peak sales valuation also gives Dynavax substantial upside if HEPLISAV-B is approved.