We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Dillard’s, Inc. (NYSE:DDS).

Hedge fund interest in Dillard’s, Inc. (NYSE:DDS) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Forward Air Corporation (NASDAQ:FWRD), Hope Bancorp, Inc. (NASDAQ:HOPE), and KB Home (NYSE:KBH) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action surrounding Dillard’s, Inc. (NYSE:DDS).

How have hedgies been trading Dillard’s, Inc. (NYSE:DDS)?

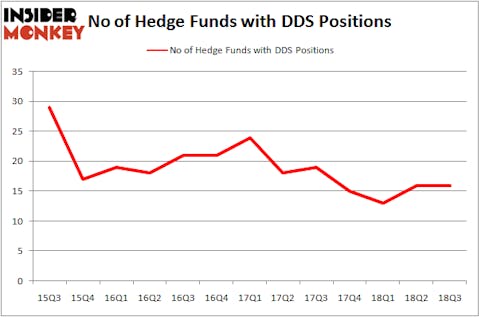

Heading into the fourth quarter of 2018, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, no change from the previous quarter. The graph below displays the number of hedge funds with bullish position in DDS over the last 13 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, AQR Capital Management, managed by Cliff Asness, holds the most valuable position in Dillard’s, Inc. (NYSE:DDS). AQR Capital Management has a $43.1 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Sitting at the No. 2 spot is Lee Ainslie of Maverick Capital, with a $28 million position; 0.3% of its 13F portfolio is allocated to the stock. Some other members of the smart money that are bullish encompass Israel Englander’s Millennium Management, John Tompkins’s Tyvor Capital and Ken Griffin’s Citadel Investment Group.

Judging by the fact that Dillard’s, Inc. (NYSE:DDS) has faced declining sentiment from the smart money, it’s safe to say that there is a sect of hedgies that slashed their entire stakes last quarter. It’s worth mentioning that Jeffrey Pierce’s Snow Park Capital Partners said goodbye to the biggest investment of the 700 funds monitored by Insider Monkey, worth close to $10.6 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund said goodbye to about $6.1 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Dillard’s, Inc. (NYSE:DDS) but similarly valued. We will take a look at Forward Air Corporation (NASDAQ:FWRD), Hope Bancorp, Inc. (NASDAQ:HOPE), KB Home (NYSE:KBH), and Premier Financial Bancorp, Inc. (NASDAQ:PFBI). This group of stocks’ market caps resemble DDS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FWRD | 15 | 100893 | -1 |

| HOPE | 14 | 81903 | 7 |

| KBH | 17 | 331197 | 3 |

| PFBI | 4 | 15565 | 1 |

| Average | 12.5 | 132390 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $132 million. That figure was $154 million in DDS’s case. KB Home (NYSE:KBH) is the most popular stock in this table. On the other hand Premier Financial Bancorp, Inc. (NASDAQ:PFBI) is the least popular one with only 4 bullish hedge fund positions. Dillard’s, Inc. (NYSE:DDS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KBH might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.