Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Daqo New Energy Corp (NYSE:DQ).

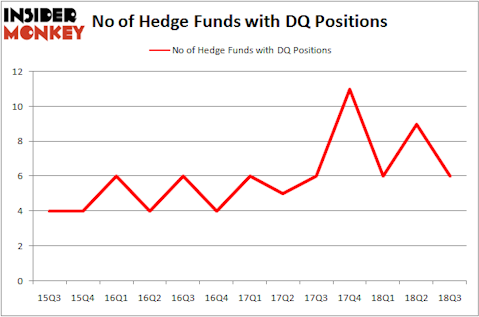

Is Daqo New Energy Corp (NYSE:DQ) ready to rally soon? The best stock pickers are becoming less confident. The number of bullish hedge fund bets decreased by 3 lately. Our calculations also showed that DQ isn’t among the 30 most popular stocks among hedge funds. DQ was in 6 hedge funds’ portfolios at the end of September. There were 9 hedge funds in our database with DQ holdings at the end of the previous quarter.

In the financial world there are a multitude of indicators stock market investors have at their disposal to grade their stock investments. A pair of the best indicators are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the top money managers can outclass the S&P 500 by a superb margin (see the details here).

Cliff Asness of AQR Capital Management

Let’s take a look at the fresh hedge fund action surrounding Daqo New Energy Corp (NYSE:DQ).

Hedge fund activity in Daqo New Energy Corp (NYSE:DQ)

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -33% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in DQ over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Daqo New Energy Corp (NYSE:DQ) was held by Millennium Management, which reported holding $12.8 million worth of stock at the end of September. It was followed by Sensato Capital Management with a $9.5 million position. Other investors bullish on the company included Arrowstreet Capital, Ecofin Ltd, and AQR Capital Management.

Since Daqo New Energy Corp (NYSE:DQ) has experienced falling interest from hedge fund managers, we can see that there exists a select few money managers who sold off their full holdings in the third quarter. Interestingly, Jonathan Barrett and Paul Segal’s Luminus Management sold off the largest position of all the hedgies monitored by Insider Monkey, valued at an estimated $8.6 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund dropped about $3.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 3 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Daqo New Energy Corp (NYSE:DQ) but similarly valued. We will take a look at Howard Bancorp Inc (NASDAQ:HBMD), Nebula Acquisition Corporation (NASDAQ:NEBU), Southern Missouri Bancorp, Inc. (NASDAQ:SMBC), and KKR Income Opportunities Fund (NYSE:KIO). This group of stocks’ market caps are similar to DQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HBMD | 3 | 14577 | 0 |

| NEBU | 18 | 130551 | 1 |

| SMBC | 3 | 13648 | 0 |

| KIO | 2 | 2156 | 1 |

| Average | 6.5 | 40233 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 6.5 hedge funds with bullish positions and the average amount invested in these stocks was $40 million. That figure was $33 million in DQ’s case. Nebula Acquisition Corporation (NASDAQ:NEBU) is the most popular stock in this table. On the other hand KKR Income Opportunities Fund (NYSE:KIO) is the least popular one with only 2 bullish hedge fund positions. Daqo New Energy Corp (NYSE:DQ) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NEBU might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.