“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards CyberOptics Corporation (NASDAQ:CYBE) and see how it was affected.

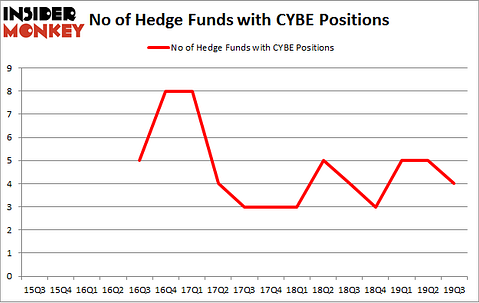

Is CyberOptics Corporation (NASDAQ:CYBE) a buy here? Prominent investors are taking a bearish view. The number of bullish hedge fund bets shrunk by 1 recently. Our calculations also showed that CYBE isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). CYBE was in 4 hedge funds’ portfolios at the end of September. There were 5 hedge funds in our database with CYBE holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a multitude of formulas investors employ to assess stocks. A couple of the best formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace their index-focused peers by a superb margin (see the details here).

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now let’s analyze the new hedge fund action regarding CyberOptics Corporation (NASDAQ:CYBE).

What does smart money think about CyberOptics Corporation (NASDAQ:CYBE)?

At the end of the third quarter, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the previous quarter. On the other hand, there were a total of 4 hedge funds with a bullish position in CYBE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Chuck Royce’s Royce & Associates has the most valuable position in CyberOptics Corporation (NASDAQ:CYBE), worth close to $4.3 million, amounting to less than 0.1%% of its total 13F portfolio. Coming in second is Josh Goldberg of G2 Investment Partners Management, with a $0.6 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Paul Marshall and Ian Wace’s Marshall Wace, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital and . In terms of the portfolio weights assigned to each position G2 Investment Partners Management allocated the biggest weight to CyberOptics Corporation (NASDAQ:CYBE), around 0.17% of its 13F portfolio. Royce & Associates is also relatively very bullish on the stock, designating 0.04 percent of its 13F equity portfolio to CYBE.

Judging by the fact that CyberOptics Corporation (NASDAQ:CYBE) has faced falling interest from the smart money, we can see that there lies a certain “tier” of hedge funds that elected to cut their entire stakes heading into Q4. At the top of the heap, Israel Englander’s Millennium Management cut the largest position of the “upper crust” of funds followed by Insider Monkey, totaling close to $0.5 million in stock. David E. Shaw’s fund, D E Shaw, also dumped its stock, about $0.2 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds heading into Q4.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as CyberOptics Corporation (NASDAQ:CYBE) but similarly valued. We will take a look at Energous Corporation (NASDAQ:WATT), Matinas Biopharma Holdings, Inc. (NYSE:MTNB), Immunic, Inc. (NASDAQ:IMUX), and Ranger Energy Services, Inc. (NYSE:RNGR). This group of stocks’ market values are similar to CYBE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WATT | 5 | 1776 | 2 |

| MTNB | 5 | 6851 | 0 |

| IMUX | 2 | 540 | 0 |

| RNGR | 3 | 4010 | 0 |

| Average | 3.75 | 3294 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $6 million in CYBE’s case. Energous Corporation (NASDAQ:WATT) is the most popular stock in this table. On the other hand Immunic, Inc. (NASDAQ:IMUX) is the least popular one with only 2 bullish hedge fund positions. CyberOptics Corporation (NASDAQ:CYBE) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on CYBE as the stock returned 24.3% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.