Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 817 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Crocs, Inc. (NASDAQ:CROX), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

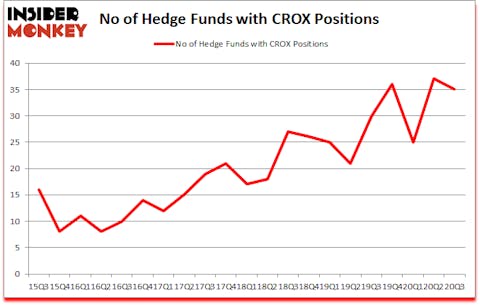

Is CROX a good stock to buy? Crocs, Inc. (NASDAQ:CROX) was in 35 hedge funds’ portfolios at the end of the third quarter of 2020. The all time high for this statistic is 37. CROX has experienced a decrease in activity from the world’s largest hedge funds lately. There were 37 hedge funds in our database with CROX holdings at the end of June. Our calculations also showed that CROX isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many signals stock traders have at their disposal to size up their holdings. A duo of the most under-the-radar signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the broader indices by a solid margin (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 15 best blue chip stocks to buy to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind let’s take a gander at the fresh hedge fund action surrounding Crocs, Inc. (NASDAQ:CROX).

Do Hedge Funds Think CROX Is A Good Stock To Buy Now?

Heading into the fourth quarter of 2020, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the second quarter of 2020. Below, you can check out the change in hedge fund sentiment towards CROX over the last 21 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, holds the number one position in Crocs, Inc. (NASDAQ:CROX). Renaissance Technologies has a $96.9 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by James Woodson Davis of Woodson Capital Management, with a $89.8 million position; 5.1% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish include Alexander Mitchell’s Scopus Asset Management, Robert Pohly’s Samlyn Capital and James Parsons’s Junto Capital Management. In terms of the portfolio weights assigned to each position Woodson Capital Management allocated the biggest weight to Crocs, Inc. (NASDAQ:CROX), around 5.13% of its 13F portfolio. Polaris Capital Management is also relatively very bullish on the stock, earmarking 2.48 percent of its 13F equity portfolio to CROX.

Judging by the fact that Crocs, Inc. (NASDAQ:CROX) has witnessed falling interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of fund managers that slashed their full holdings by the end of the third quarter. Intriguingly, Gabriel Plotkin’s Melvin Capital Management cut the largest position of all the hedgies tracked by Insider Monkey, comprising close to $45.1 million in stock. Zachary Miller’s fund, Parian Global Management, also dumped its stock, about $13.1 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 2 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Crocs, Inc. (NASDAQ:CROX). We will take a look at Immunovant, Inc. (NASDAQ:IMVT), BMC Stock Holdings, Inc. (NASDAQ:BMCH), Momo Inc (NASDAQ:MOMO), Digital Turbine Inc (NASDAQ:APPS), Univar Solutions Inc (NYSE:UNVR), EnerSys (NYSE:ENS), and Sorrento Therapeutics Inc (NASDAQ:SRNE). This group of stocks’ market values are similar to CROX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IMVT | 29 | 562531 | -2 |

| BMCH | 31 | 571107 | 5 |

| MOMO | 30 | 362883 | -4 |

| APPS | 23 | 332289 | 5 |

| UNVR | 30 | 839273 | -1 |

| ENS | 22 | 107763 | -4 |

| SRNE | 13 | 100794 | 1 |

| Average | 25.4 | 410949 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.4 hedge funds with bullish positions and the average amount invested in these stocks was $411 million. That figure was $654 million in CROX’s case. BMC Stock Holdings, Inc. (NASDAQ:BMCH) is the most popular stock in this table. On the other hand Sorrento Therapeutics Inc (NASDAQ:SRNE) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Crocs, Inc. (NASDAQ:CROX) is more popular among hedge funds. Our overall hedge fund sentiment score for CROX is 81.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks returned 33.3% in 2020 through December 18th but still managed to beat the market by 16.4 percentage points. Hedge funds were also right about betting on CROX as the stock returned 50.7% since the end of September (through 12/18) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Crocs Inc. (NASDAQ:CROX)

Follow Crocs Inc. (NASDAQ:CROX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.