The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Constellation Brands, Inc. (NYSE:STZ).

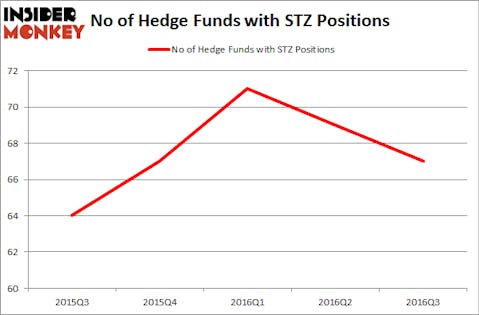

So, is Constellation Brands, Inc. (NYSE:STZ) a bargain? Prominent investors seem to be becoming less confident. The number of long hedge fund positions went down by two lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Twenty-First Century Fox Inc (NASDAQ:FOXA), CME Group Inc (NASDAQ:CME), and CIGNA Corporation (NYSE:CI) to gather more data points.

Follow Constellation Brands Inc. (NYSE:STZ)

Follow Constellation Brands Inc. (NYSE:STZ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: iakovenko / 123RF Stock Photo

Keeping this in mind, we’re going to take a peek at the key action regarding Constellation Brands, Inc. (NYSE:STZ).

How are hedge funds trading Constellation Brands, Inc. (NYSE:STZ)?

A total of 67 funds tracked by Insider Monkey held shares of Constellation Brands at the end of September, down by 3% over the quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Michael Lowenstein’s Kensico Capital has the most valuable position in Constellation Brands, Inc. (NYSE:STZ), worth close to $967.1 million, accounting for 17.7% of its total 13F portfolio. Sitting at the No. 2 spot is Stephen Mandel of Lone Pine Capital, with a $926.8 million position; 4.1% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish contain Andreas Halvorsen’s Viking Global, John Armitage’s Egerton Capital Limited, and Dan Loeb’s Third Point.

Because Constellation Brands, Inc. (NYSE:STZ) has witnessed bearish sentiment from hedge fund managers, we can see that there lies a certain “tier” of hedgies who sold off their positions entirely during the third quarter. Interestingly, Ken Griffin’s Citadel Investment Group dropped the biggest position of the 700 funds tracked by Insider Monkey, worth an estimated $18.2 million in call options.. Sheetal Duggal’s fund, Thrax Management, also dumped its call options, about $10.8 million worth.

Let’s now review hedge fund activity in other stocks similar to Constellation Brands, Inc. (NYSE:STZ). We will take a look at Twenty-First Century Fox Inc (NASDAQ:FOXA), CME Group Inc (NASDAQ:CME), CIGNA Corporation (NYSE:CI), and Brookfield Asset Management Inc. (USA) (NYSE:BAM). All of these stocks’ market caps match STZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOXA | 48 | 3558064 | -1 |

| CME | 48 | 980224 | -1 |

| CI | 55 | 3154370 | -4 |

| BAM | 19 | 1161171 | -2 |

As you can see these stocks had an average of 43 investors holding shares and the average amount invested in these stocks was $2.21 billion. That figure was $6.68 billion in STZ’s case. CIGNA Corporation (NYSE:CI) is the most popular stock in this table with 55 funds holding shares. On the other hand Brookfield Asset Management Inc. (USA) (NYSE:BAM) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Constellation Brands, Inc. (NYSE:STZ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.