Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about CIT Group Inc. (NYSE:CIT) in this article.

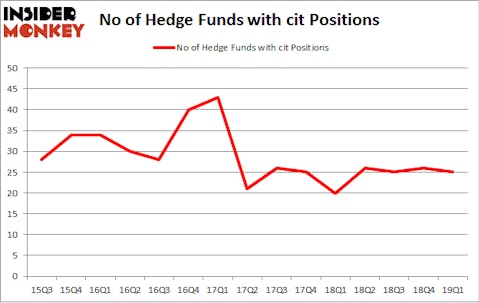

CIT Group Inc. (NYSE:CIT) was in 25 hedge funds’ portfolios at the end of the first quarter of 2019. CIT investors should pay attention to a decrease in hedge fund sentiment of late. There were 26 hedge funds in our database with CIT holdings at the end of the previous quarter. Our calculations also showed that cit isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are plenty of metrics stock market investors have at their disposal to appraise publicly traded companies. A couple of the less known metrics are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the top investment managers can outclass the market by a significant amount (see the details here).

We’re going to review the latest hedge fund action encompassing CIT Group Inc. (NYSE:CIT).

What does the smart money think about CIT Group Inc. (NYSE:CIT)?

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CIT over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, First Pacific Advisors LLC was the largest shareholder of CIT Group Inc. (NYSE:CIT), with a stake worth $445.6 million reported as of the end of March. Trailing First Pacific Advisors LLC was Lakewood Capital Management, which amassed a stake valued at $127.1 million. Renaissance Technologies, MFP Investors, and Owl Creek Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as CIT Group Inc. (NYSE:CIT) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there were a few hedge funds that decided to sell off their entire stakes heading into Q3. Interestingly, Israel Englander’s Millennium Management dropped the largest investment of all the hedgies watched by Insider Monkey, comprising close to $16.7 million in stock. Matthew Lindenbaum’s fund, Basswood Capital, also cut its stock, about $8 million worth. These moves are intriguing to say the least, as total hedge fund interest fell by 1 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks similar to CIT Group Inc. (NYSE:CIT). These stocks are ADT Inc (NYSE:ADT), Nuance Communications Inc. (NASDAQ:NUAN), Prosperity Bancshares, Inc. (NYSE:PB), and 51job, Inc. (NASDAQ:JOBS). All of these stocks’ market caps match CIT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADT | 16 | 85421 | 1 |

| NUAN | 28 | 459833 | -7 |

| PB | 9 | 103636 | 0 |

| JOBS | 12 | 29384 | -1 |

| Average | 16.25 | 169569 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.25 hedge funds with bullish positions and the average amount invested in these stocks was $170 million. That figure was $774 million in CIT’s case. Nuance Communications Inc. (NASDAQ:NUAN) is the most popular stock in this table. On the other hand Prosperity Bancshares, Inc. (NYSE:PB) is the least popular one with only 9 bullish hedge fund positions. CIT Group Inc. (NYSE:CIT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CIT as the stock returned 3.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.