The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Cerence Inc. (NASDAQ:CRNC).

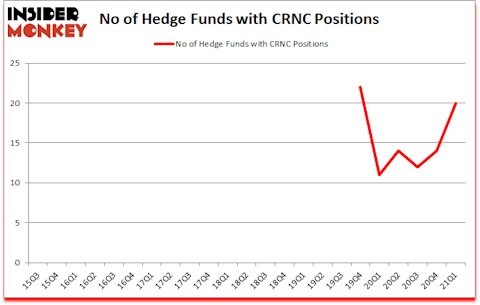

Is CRNC a good stock to buy? Cerence Inc. (NASDAQ:CRNC) was in 20 hedge funds’ portfolios at the end of March. The all time high for this statistic is 22. CRNC has seen an increase in hedge fund interest of late. There were 14 hedge funds in our database with CRNC holdings at the end of December. Our calculations also showed that CRNC isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

According to most stock holders, hedge funds are assumed to be slow, outdated financial tools of years past. While there are more than 8000 funds with their doors open at present, Our experts hone in on the moguls of this club, approximately 850 funds. Most estimates calculate that this group of people command the lion’s share of all hedge funds’ total capital, and by paying attention to their first-class investments, Insider Monkey has deciphered numerous investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to take a gander at the latest hedge fund action surrounding Cerence Inc. (NASDAQ:CRNC).

Do Hedge Funds Think CRNC Is A Good Stock To Buy Now?

Heading into the second quarter of 2021, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 43% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards CRNC over the last 23 quarters. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Cerence Inc. (NASDAQ:CRNC) was held by Moore Global Investments, which reported holding $128.2 million worth of stock at the end of December. It was followed by Millennium Management with a $14.8 million position. Other investors bullish on the company included Citadel Investment Group, Honeycomb Asset Management, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Andar Capital allocated the biggest weight to Cerence Inc. (NASDAQ:CRNC), around 6.99% of its 13F portfolio. Isomer Partners is also relatively very bullish on the stock, earmarking 2.8 percent of its 13F equity portfolio to CRNC.

As aggregate interest increased, key money managers were leading the bulls’ herd. Honeycomb Asset Management, managed by David Fiszel, established the most outsized position in Cerence Inc. (NASDAQ:CRNC). Honeycomb Asset Management had $14.7 million invested in the company at the end of the quarter. Mark Coe’s Intrinsic Edge Capital also initiated a $4.7 million position during the quarter. The following funds were also among the new CRNC investors: Noam Gottesman’s GLG Partners, Peter Muller’s PDT Partners, and Peter Algert’s Algert Global.

Let’s now review hedge fund activity in other stocks similar to Cerence Inc. (NASDAQ:CRNC). We will take a look at Cantel Medical Corp. (NYSE:CMD), Korn Ferry (NYSE:KFY), Atlas Corp. (NYSE:ATCO), NuVasive, Inc. (NASDAQ:NUVA), Kratos Defense & Security Solutions, Inc (NASDAQ:KTOS), Revolution Medicines, Inc. (NASDAQ:RVMD), and Mercury General Corporation (NYSE:MCY). This group of stocks’ market values are similar to CRNC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMD | 30 | 592747 | 8 |

| KFY | 16 | 226581 | -1 |

| ATCO | 12 | 1424585 | -6 |

| NUVA | 20 | 272025 | -5 |

| KTOS | 16 | 194053 | -2 |

| RVMD | 26 | 643312 | 0 |

| MCY | 20 | 178505 | 2 |

| Average | 20 | 504544 | -0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $505 million. That figure was $213 million in CRNC’s case. Cantel Medical Corp. (NYSE:CMD) is the most popular stock in this table. On the other hand Atlas Corp. (NYSE:ATCO) is the least popular one with only 12 bullish hedge fund positions. Cerence Inc. (NASDAQ:CRNC) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for CRNC is 59.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and still beat the market by 7.7 percentage points. A small number of hedge funds were also right about betting on CRNC as the stock returned 20.8% since the end of the first quarter (through 7/16) and outperformed the market by an even larger margin.

Follow Cerence Inc. (NASDAQ:CRNC)

Follow Cerence Inc. (NASDAQ:CRNC)

Receive real-time insider trading and news alerts

Suggested Articles:

- 12 Best Infrastructure Stocks To Buy Now

- 10 High Yield Dividend Stocks to Buy According to Billionaire David Harding

- 10 Best Battery ETFs to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.