Is Century Communities, Inc (NYSE:CCS) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

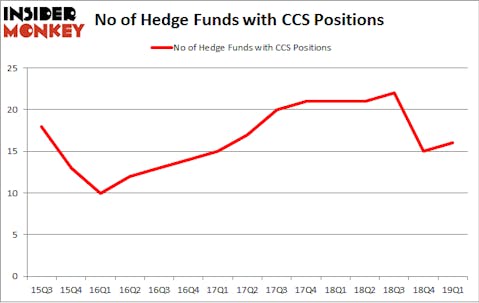

Century Communities, Inc (NYSE:CCS) was in 16 hedge funds’ portfolios at the end of March. CCS investors should pay attention to an increase in support from the world’s most elite money managers recently. There were 15 hedge funds in our database with CCS positions at the end of the previous quarter. Our calculations also showed that ccs isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of methods stock traders can use to assess publicly traded companies. A duo of the most underrated methods are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outpace their index-focused peers by a healthy margin (see the details here).

We’re going to take a gander at the key hedge fund action regarding Century Communities, Inc (NYSE:CCS).

How have hedgies been trading Century Communities, Inc (NYSE:CCS)?

Heading into the second quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 7% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in CCS over the last 15 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

The largest stake in Century Communities, Inc (NYSE:CCS) was held by Long Pond Capital, which reported holding $58.3 million worth of stock at the end of March. It was followed by Oaktree Capital Management with a $43.6 million position. Other investors bullish on the company included Basswood Capital, Shoals Capital Management, and Buckingham Capital Management.

Now, key hedge funds have been driving this bullishness. Cloverdale Capital Management, managed by C. Jonathan Gattman, initiated the most outsized position in Century Communities, Inc (NYSE:CCS). Cloverdale Capital Management had $11.3 million invested in the company at the end of the quarter. Chuck Royce’s Royce & Associates also initiated a $2.1 million position during the quarter. The other funds with brand new CCS positions are Paul Marshall and Ian Wace’s Marshall Wace LLP and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Century Communities, Inc (NYSE:CCS) but similarly valued. We will take a look at Extraction Oil & Gas, Inc. (NASDAQ:XOG), Forestar Group Inc. (NYSE:FOR), Opera Limited (NASDAQ:OPRA), and Horizon Bancorp, Inc. (NASDAQ:HBNC). This group of stocks’ market valuations are similar to CCS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XOG | 20 | 130068 | -2 |

| FOR | 7 | 71999 | 1 |

| OPRA | 5 | 6930 | 0 |

| HBNC | 10 | 19043 | 4 |

| Average | 10.5 | 57010 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $57 million. That figure was $197 million in CCS’s case. Extraction Oil & Gas, Inc. (NASDAQ:XOG) is the most popular stock in this table. On the other hand Opera Limited (NASDAQ:OPRA) is the least popular one with only 5 bullish hedge fund positions. Century Communities, Inc (NYSE:CCS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on CCS as the stock returned 12.2% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.