“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Cemex SAB de CV (NYSE:CX) and see how it was affected.

Is Cemex SAB de CV (NYSE:CX) a good investment now? Prominent investors are getting more optimistic. The number of long hedge fund positions inched up by 5 in recent months. Our calculations also showed that CX isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the fresh hedge fund action surrounding Cemex SAB de CV (NYSE:CX).

What does smart money think about Cemex SAB de CV (NYSE:CX)?

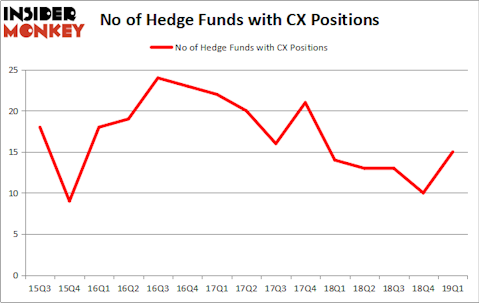

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in CX over the last 15 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Oaktree Capital Management, managed by Howard Marks, holds the number one position in Cemex SAB de CV (NYSE:CX). Oaktree Capital Management has a $29.4 million position in the stock, comprising 0.6% of its 13F portfolio. On Oaktree Capital Management’s heels is Fisher Asset Management, led by Ken Fisher, holding a $29.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism include Jim Simons’s Renaissance Technologies, Thomas E. Claugus’s GMT Capital and David Kowitz and Sheldon Kasowitz’s Indus Capital.

As industrywide interest jumped, key money managers were breaking ground themselves. Renaissance Technologies, managed by Jim Simons, established the largest position in Cemex SAB de CV (NYSE:CX). Renaissance Technologies had $8.1 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $2 million position during the quarter. The other funds with brand new CX positions are Matthew Hulsizer’s PEAK6 Capital Management, Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital, and Allan Teh’s Kamunting Street Capital.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Cemex SAB de CV (NYSE:CX) but similarly valued. These stocks are Qurate Retail, Inc. (NASDAQ:QRTEA), Five Below Inc (NASDAQ:FIVE), Teradyne, Inc. (NASDAQ:TER), and Alaska Air Group, Inc. (NYSE:ALK). All of these stocks’ market caps are closest to CX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QRTEA | 33 | 725955 | -2 |

| FIVE | 38 | 487778 | 6 |

| TER | 24 | 564379 | -1 |

| ALK | 20 | 466021 | -12 |

| Average | 28.75 | 561033 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $561 million. That figure was $91 million in CX’s case. Five Below Inc (NASDAQ:FIVE) is the most popular stock in this table. On the other hand Alaska Air Group, Inc. (NYSE:ALK) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Cemex SAB de CV (NYSE:CX) is even less popular than ALK. Hedge funds dodged a bullet by taking a bearish stance towards CX. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately CX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CX investors were disappointed as the stock returned -9.5% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.