The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their September 30 holdings, data that is available nowhere else. Should you consider CDK Global Inc (NASDAQ:CDK) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

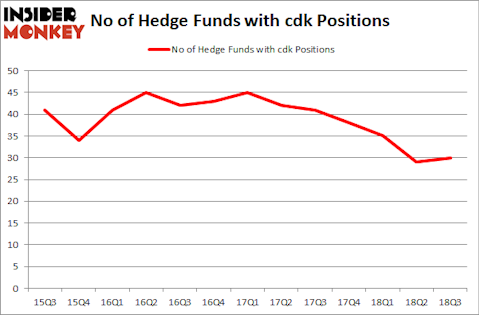

Is CDK Global Inc (NASDAQ:CDK) a healthy stock for your portfolio? Money managers are in a bullish mood. The number of bullish hedge fund positions increased by 1 lately. Our calculations also showed that cdk isn’t among the 30 most popular stocks among hedge funds. CDK was in 30 hedge funds’ portfolios at the end of September. There were 29 hedge funds in our database with CDK positions at the end of the previous quarter.

To the average investor there are dozens of formulas stock market investors employ to appraise their holdings. Some of the most useful formulas are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite investment managers can trounce the broader indices by a healthy margin (see the details here).

We’re going to take a gander at the recent hedge fund action surrounding CDK Global Inc (NASDAQ:CDK).

What have hedge funds been doing with CDK Global Inc (NASDAQ:CDK)?

Heading into the fourth quarter of 2018, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards CDK over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

The largest stake in CDK Global Inc (NASDAQ:CDK) was held by Senator Investment Group, which reported holding $188 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $100.7 million position. Other investors bullish on the company included Lakewood Capital Management, D E Shaw, and AQR Capital Management.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Sunriver Management, managed by Will Cook, initiated the most outsized position in CDK Global Inc (NASDAQ:CDK). Sunriver Management had $16.2 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also made a $4.4 million investment in the stock during the quarter. The following funds were also among the new CDK investors: Matthew Hulsizer’s PEAK6 Capital Management, Hugh Sloane’s Sloane Robinson Investment Management, and Philip Hempleman’s Ardsley Partners.

Let’s now review hedge fund activity in other stocks similar to CDK Global Inc (NASDAQ:CDK). These stocks are Aspen Technology, Inc. (NASDAQ:AZPN), Nordson Corporation (NASDAQ:NDSN), Public Joint-Stock Company Mobile TeleSystems (NYSE:MBT), and KAR Auction Services Inc (NYSE:KAR). All of these stocks’ market caps resemble CDK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZPN | 28 | 1199848 | 3 |

| NDSN | 16 | 54837 | 1 |

| MBT | 11 | 253236 | -3 |

| KAR | 28 | 757789 | -1 |

| Average | 20.75 | 566428 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $566 million. That figure was $957 million in CDK’s case. Aspen Technology, Inc. (NASDAQ:AZPN) is the most popular stock in this table. On the other hand Mobile TeleSystems OJSC (NYSE:MBT) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks CDK Global Inc (NASDAQ:CDK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.