Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter. Trends reversed 180 degrees during the first quarter amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the first quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Carrols Restaurant Group, Inc. (NASDAQ:TAST).

Is Carrols Restaurant Group, Inc. (NASDAQ:TAST) an excellent stock to buy now? Hedge funds are turning bullish. The number of long hedge fund positions rose by 2 lately. Our calculations also showed that tast isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are viewed as slow, outdated financial vehicles of the past. While there are over 8000 funds in operation today, Our experts choose to focus on the masters of this club, around 750 funds. These hedge fund managers manage bulk of the hedge fund industry’s total capital, and by observing their best equity investments, Insider Monkey has figured out various investment strategies that have historically exceeded the market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s view the new hedge fund action regarding Carrols Restaurant Group, Inc. (NASDAQ:TAST).

Hedge fund activity in Carrols Restaurant Group, Inc. (NASDAQ:TAST)

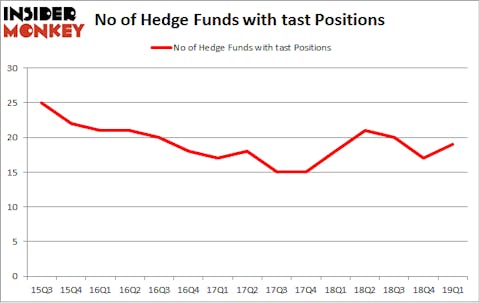

At the end of the first quarter, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 12% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards TAST over the last 15 quarters. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

Among these funds, Private Capital Management held the most valuable stake in Carrols Restaurant Group, Inc. (NASDAQ:TAST), which was worth $24 million at the end of the first quarter. On the second spot was Cannell Capital which amassed $17.8 million worth of shares. Moreover, Royce & Associates, Cove Street Capital, and Portolan Capital Management were also bullish on Carrols Restaurant Group, Inc. (NASDAQ:TAST), allocating a large percentage of their portfolios to this stock.

Consequently, specific money managers were breaking ground themselves. Half Sky Capital, managed by Li Ran, established the largest position in Carrols Restaurant Group, Inc. (NASDAQ:TAST). Half Sky Capital had $7.2 million invested in the company at the end of the quarter. Warren Lammert’s Granite Point Capital also made a $1.8 million investment in the stock during the quarter. The only other fund with a new position in the stock is Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Carrols Restaurant Group, Inc. (NASDAQ:TAST). These stocks are Digimarc Corp (NASDAQ:DMRC), Hingham Institution for Savings (NASDAQ:HIFS), Green Plains Partners LP (NASDAQ:GPP), and HCI Group, Inc. (NYSE:HCI). All of these stocks’ market caps are similar to TAST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DMRC | 3 | 33204 | -1 |

| HIFS | 1 | 4077 | 0 |

| GPP | 2 | 4807 | 0 |

| HCI | 9 | 20098 | 0 |

| Average | 3.75 | 15547 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3.75 hedge funds with bullish positions and the average amount invested in these stocks was $16 million. That figure was $109 million in TAST’s case. HCI Group, Inc. (NYSE:HCI) is the most popular stock in this table. On the other hand Hingham Institution for Savings (NASDAQ:HIFS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Carrols Restaurant Group, Inc. (NASDAQ:TAST) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately TAST wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on TAST were disappointed as the stock returned -15.3% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.