Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Cadence Design Systems Inc (NASDAQ:CDNS) and see how the stock is affected by the recent hedge fund activity.

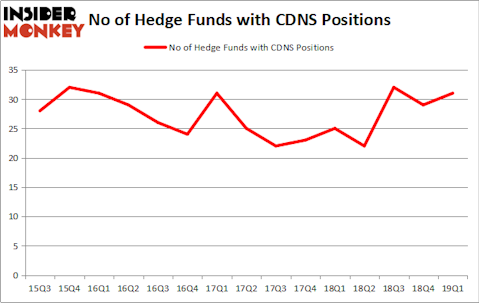

Cadence Design Systems Inc (NASDAQ:CDNS) has experienced an increase in hedge fund sentiment recently. Our calculations also showed that CDNS isn’t among the 30 most popular stocks among hedge funds.

Today there are a lot of tools stock traders employ to appraise stocks. A pair of the most under-the-radar tools are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the elite fund managers can outperform the market by a superb amount (see the details here).

We’re going to take a look at the latest hedge fund action regarding Cadence Design Systems Inc (NASDAQ:CDNS).

What have hedge funds been doing with Cadence Design Systems Inc (NASDAQ:CDNS)?

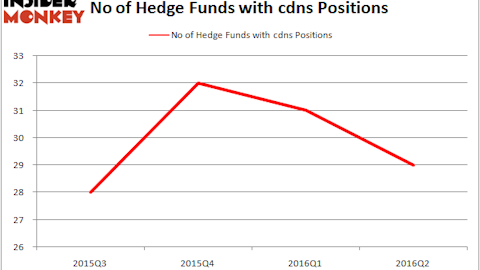

Heading into the second quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CDNS over the last 15 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Alkeon Capital Management held the most valuable stake in Cadence Design Systems Inc (NASDAQ:CDNS), which was worth $361.3 million at the end of the first quarter. On the second spot was AQR Capital Management which amassed $265.4 million worth of shares. Moreover, Arrowstreet Capital, GLG Partners, and Citadel Investment Group were also bullish on Cadence Design Systems Inc (NASDAQ:CDNS), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, specific money managers have jumped into Cadence Design Systems Inc (NASDAQ:CDNS) headfirst. Adage Capital Management, managed by Phill Gross and Robert Atchinson, assembled the largest position in Cadence Design Systems Inc (NASDAQ:CDNS). Adage Capital Management had $6.2 million invested in the company at the end of the quarter. Louis Navellier’s Navellier & Associates also made a $4.4 million investment in the stock during the quarter. The following funds were also among the new CDNS investors: Tor Minesuk’s Mondrian Capital, Zach Schreiber’s Point State Capital, and Bruce Kovner’s Caxton Associates LP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Cadence Design Systems Inc (NASDAQ:CDNS) but similarly valued. These stocks are Plains All American Pipeline, L.P. (NYSE:PAA), Nucor Corporation (NYSE:NUE), CBS Corporation (NYSE:CBS), and POSCO (NYSE:PKX). This group of stocks’ market valuations are similar to CDNS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAA | 8 | 96116 | 0 |

| NUE | 26 | 319449 | 0 |

| CBS | 46 | 1474862 | 1 |

| PKX | 11 | 66584 | -4 |

| Average | 22.75 | 489253 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $489 million. That figure was $1645 million in CDNS’s case. CBS Corporation (NYSE:CBS) is the most popular stock in this table. On the other hand Plains All American Pipeline, L.P. (NYSE:PAA) is the least popular one with only 8 bullish hedge fund positions. Cadence Design Systems Inc (NASDAQ:CDNS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on CDNS, though not to the same extent, as the stock returned 1.3% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.