Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

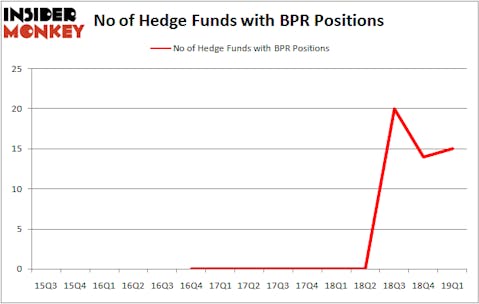

Is Brookfield Property REIT Inc. (NASDAQ:BPR) a buy here? Money managers are betting on the stock. The number of bullish hedge fund bets moved up by 1 in recent months. Our calculations also showed that BPR isn’t among the 30 most popular stocks among hedge funds. BPR was in 15 hedge funds’ portfolios at the end of March. There were 14 hedge funds in our database with BPR holdings at the end of the previous quarter.

In today’s marketplace there are numerous formulas investors employ to size up stocks. A couple of the most innovative formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the top fund managers can trounce the market by a healthy margin (see the details here).

Paul Marshall of Marshall Wace

Let’s take a peek at the new hedge fund action surrounding Brookfield Property REIT Inc. (NASDAQ:BPR).

How are hedge funds trading Brookfield Property REIT Inc. (NASDAQ:BPR)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BPR over the last 15 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

Among these funds, D E Shaw held the most valuable stake in Brookfield Property REIT Inc. (NASDAQ:BPR), which was worth $28.6 million at the end of the first quarter. On the second spot was Two Sigma Advisors which amassed $10.9 million worth of shares. Moreover, Millennium Management, Arrowstreet Capital, and Marshall Wace LLP were also bullish on Brookfield Property REIT Inc. (NASDAQ:BPR), allocating a large percentage of their portfolios to this stock.

Consequently, some big names were leading the bulls’ herd. ExodusPoint Capital, managed by Michael Gelband, created the most outsized position in Brookfield Property REIT Inc. (NASDAQ:BPR). ExodusPoint Capital had $3.1 million invested in the company at the end of the quarter. David Costen Haley’s HBK Investments also initiated a $0.5 million position during the quarter. The other funds with brand new BPR positions are Jonathan Soros’s JS Capital, Matthew Tewksbury’s Stevens Capital Management, and Murray Stahl’s Horizon Asset Management.

Let’s check out hedge fund activity in other stocks similar to Brookfield Property REIT Inc. (NASDAQ:BPR). These stocks are Ryanair Holdings plc (NASDAQ:RYAAY), Laboratory Corp. of America Holdings (NYSE:LH), Darden Restaurants, Inc. (NYSE:DRI), and Citizens Financial Group Inc (NYSE:CFG). This group of stocks’ market caps are closest to BPR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RYAAY | 18 | 429319 | 9 |

| LH | 39 | 1198920 | 1 |

| DRI | 38 | 1016976 | 1 |

| CFG | 41 | 1207295 | -2 |

| Average | 34 | 963128 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $963 million. That figure was $85 million in BPR’s case. Citizens Financial Group Inc (NYSE:CFG) is the most popular stock in this table. On the other hand Ryanair Holdings plc (NASDAQ:RYAAY) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Brookfield Property REIT Inc. (NASDAQ:BPR) is even less popular than RYAAY. Hedge funds dodged a bullet by taking a bearish stance towards BPR. Our calculations showed that the top 20 most popular hedge fund stocks returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately BPR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); BPR investors were disappointed as the stock returned -4.5% during the same time frame and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in the second quarter.

Disclosure: None. This article was originally published at Insider Monkey.