Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

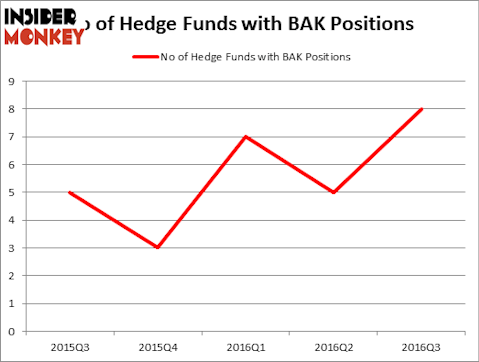

Braskem SA (ADR) (NYSE:BAK) investors should pay attention to an increase in hedge fund interest recently. BAK was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. There were 5 hedge funds in our database with BAK holdings at the end of the previous quarter. At the end of this article we will also compare BAK to other stocks including Owens Corning (NYSE:OC), VimpelCom Ltd (ADR) (NYSE:VIP), and Steel Dynamics, Inc. (NASDAQ:STLD) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

How are hedge funds trading Braskem SA (ADR) (NYSE:BAK)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 60% from the previous quarter. On the other hand, there were a total of 3 hedge funds with a bullish position in BAK at the beginning of this year. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world, has the number one position in Braskem SA (ADR) (NYSE:BAK), worth close to $33.6 million. On Renaissance Technologies’ heels is Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital holding a $5.2 million position. Other peers with similar optimism comprise Israel Englander’s Millennium Management, Jon Bauer’s Contrarian Capital and Robert B. Gillam’s McKinley Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.