Coronavirus is probably the #1 concern in investors’ minds right now. It should be. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 835 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Booking Holdings Inc. (NASDAQ:BKNG) in this article.

Booking Holdings Inc. (NASDAQ:BKNG) has experienced a decrease in support from the world’s most elite money managers recently. Our calculations also showed that BKNG isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 72.9% since March 2017 and outperformed the S&P 500 ETFs by more than 41 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Andreas Halvorsen of Viking Global

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind let’s view the fresh hedge fund action encompassing Booking Holdings Inc. (NASDAQ:BKNG).

How have hedgies been trading Booking Holdings Inc. (NASDAQ:BKNG)?

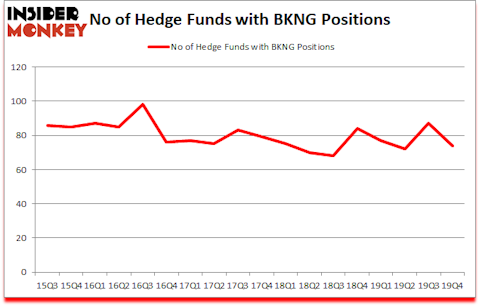

At Q4’s end, a total of 74 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in BKNG over the last 18 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in Booking Holdings Inc. (NASDAQ:BKNG). Citadel Investment Group has a $753.7 million call position in the stock, comprising 0.3% of its 13F portfolio. The second most bullish fund manager is Yacktman Asset Management, managed by Donald Yacktman, which holds a $435.7 million position; 5.5% of its 13F portfolio is allocated to the stock. Some other peers that are bullish encompass Cliff Asness’s AQR Capital Management, Sharlyn C. Heslam’s Stockbridge Partners and Paul Reeder and Edward Shapiro’s PAR Capital Management. In terms of the portfolio weights assigned to each position Harvard Management Co allocated the biggest weight to Booking Holdings Inc. (NASDAQ:BKNG), around 20.59% of its 13F portfolio. BlueDrive Global Investors is also relatively very bullish on the stock, earmarking 16.96 percent of its 13F equity portfolio to BKNG.

Due to the fact that Booking Holdings Inc. (NASDAQ:BKNG) has witnessed declining sentiment from the aggregate hedge fund industry, we can see that there was a specific group of money managers who were dropping their entire stakes in the third quarter. Interestingly, Lone Pine Capital sold off the largest investment of the 750 funds followed by Insider Monkey, comprising about $414.6 million in stock. Tim Hurd and Ed Magnus’s fund, BlueSpruce Investments, also cut its stock, about $175.8 million worth. These moves are important to note, as total hedge fund interest was cut by 13 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Booking Holdings Inc. (NASDAQ:BKNG) but similarly valued. We will take a look at Fidelity National Information Services Inc. (NYSE:FIS), Sony Corporation (NYSE:SNE), Morgan Stanley (NYSE:MS), and Gilead Sciences, Inc. (NASDAQ:GILD). This group of stocks’ market caps resemble BKNG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIS | 105 | 8073588 | 10 |

| SNE | 26 | 761509 | -1 |

| MS | 60 | 3846065 | -8 |

| GILD | 67 | 3722904 | 1 |

| Average | 64.5 | 4101017 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 64.5 hedge funds with bullish positions and the average amount invested in these stocks was $4101 million. That figure was $5579 million in BKNG’s case. Fidelity National Information Services Inc. (NYSE:FIS) is the most popular stock in this table. On the other hand Sony Corporation (NYSE:SNE) is the least popular one with only 26 bullish hedge fund positions. Booking Holdings Inc. (NASDAQ:BKNG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Unfortunately BKNG wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on BKNG were disappointed as the stock returned -15.8% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.