Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow nearly 900 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

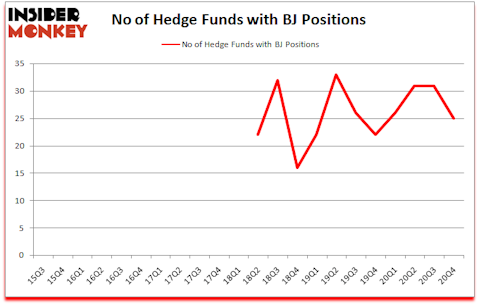

Is BJ stock a buy? BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) has seen a decrease in enthusiasm from smart money recently. BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) was in 25 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 33. Our calculations also showed that BJ isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 124 percentage points since March 2017 (see the details here).

Peter Rathjens of Arrowstreet Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to analyze the latest hedge fund action surrounding BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ).

Do Hedge Funds Think BJ Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in BJ a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Among these funds, Arrowstreet Capital held the most valuable stake in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), which was worth $39.1 million at the end of the fourth quarter. On the second spot was Simcoe Capital Management which amassed $28.9 million worth of shares. DSAM Partners, Two Sigma Advisors, and Sirios Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Simcoe Capital Management allocated the biggest weight to BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), around 4.57% of its 13F portfolio. Franklin Street Capital is also relatively very bullish on the stock, designating 3.79 percent of its 13F equity portfolio to BJ.

Seeing as BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) has experienced bearish sentiment from hedge fund managers, it’s easy to see that there exists a select few hedge funds who sold off their positions entirely last quarter. Interestingly, Richard Driehaus’s Driehaus Capital dropped the largest stake of all the hedgies watched by Insider Monkey, worth an estimated $4.1 million in stock, and Blair Baker’s Precept Capital Management was right behind this move, as the fund dumped about $3.5 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 6 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ). We will take a look at Douglas Emmett, Inc. (NYSE:DEI), Eidos Therapeutics, Inc. (NASDAQ:EIDX), Concentrix Corporation (NASDAQ:CNXC), Vertex, Inc. (NASDAQ:VERX), Alarm.com Holdings Inc (NASDAQ:ALRM), Hanesbrands Inc. (NYSE:HBI), and Omnicell, Inc. (NASDAQ:OMCL). This group of stocks’ market valuations resemble BJ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DEI | 21 | 482154 | -3 |

| EIDX | 22 | 427914 | 9 |

| CNXC | 21 | 406489 | 21 |

| VERX | 11 | 130337 | -4 |

| ALRM | 20 | 374519 | -4 |

| HBI | 27 | 710998 | -9 |

| OMCL | 20 | 131945 | -2 |

| Average | 20.3 | 380622 | 1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.3 hedge funds with bullish positions and the average amount invested in these stocks was $381 million. That figure was $240 million in BJ’s case. Hanesbrands Inc. (NYSE:HBI) is the most popular stock in this table. On the other hand Vertex, Inc. (NASDAQ:VERX) is the least popular one with only 11 bullish hedge fund positions. BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BJ is 65.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Hedge funds were also right about betting on BJ as the stock returned 19.2% since the end of Q4 (through 4/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Bj's Wholesale Club Holdings Inc. (NYSE:BJ)

Follow Bj's Wholesale Club Holdings Inc. (NYSE:BJ)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.