The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Banco Santander, S.A. (ADR) (NYSE:SAN).

Hedge fund interest in Banco Santander, S.A. (ADR) (NYSE:SAN) shares was flat at the end of last quarter, with 16 hedge funds bullish on the company. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Itau Unibanco Holding SA (ADR) (NYSE:ITUB), BlackRock, Inc. (NYSE:BLK), and The Dow Chemical Company (NYSE:DOW) to gather more data points.

Follow Banco Santander Chile New (NYSE:SAN)

Follow Banco Santander Chile New (NYSE:SAN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

How are hedge funds trading Banco Santander, S.A. (ADR) (NYSE:SAN)?

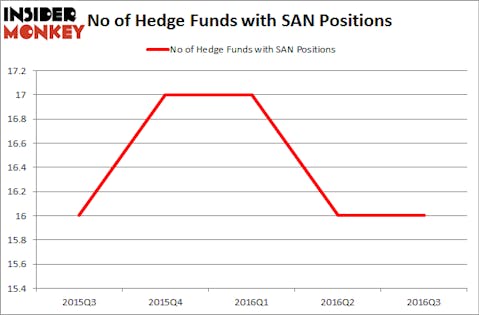

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from one quarter earlier. The graph below displays the number of hedge funds with bullish position in SAN over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, David Blood and Al Gore’s Generation Investment Management has the biggest position in Banco Santander, S.A. (ADR) (NYSE:SAN), worth close to $83.9 million. The second largest stake is held by AQR Capital Management, led by Cliff Asness, holding a $57.6 million position. Remaining peers that are bullish encompass John W. Rogers’ Ariel Investments, Renaissance Technologies, one of the largest hedge funds in the world and D. E. Shaw’s D E Shaw. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Banco Santander, S.A. (ADR) (NYSE:SAN) has sustained falling interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of funds that elected to cut their full holdings last quarter. At the top of the heap, Howard Marks’ Oaktree Capital Management sold off the largest position of the “upper crust” of funds followed by Insider Monkey, valued at close to $16.8 million in stock, and Matthew Tewksbury’s Stevens Capital Management was right behind this move, as the fund said goodbye to about $0.5 million worth of shares.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Banco Santander, S.A. (ADR) (NYSE:SAN) but similarly valued. We will take a look at Itau Unibanco Holding SA (ADR) (NYSE:ITUB), BlackRock, Inc. (NYSE:BLK), The Dow Chemical Company (NYSE:DOW), and HDFC Bank Limited (ADR) (NYSE:HDB). This group of stocks’ market values are closest to SAN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ITUB | 24 | 770320 | 2 |

| BLK | 30 | 397378 | 3 |

| DOW | 47 | 2686024 | -1 |

| HDB | 23 | 1442108 | 0 |

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $1.32 billion. That figure was $202 million in SAN’s case. The Dow Chemical Company (NYSE:DOW) is the most popular stock in this table. On the other hand HDFC Bank Limited (ADR) (NYSE:HDB) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Banco Santander, S.A. (ADR) (NYSE:SAN) is even less popular than HDB. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None