Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren’t timid and registered double digit market beating gains. Financials, energy and industrial stocks initially suffered the most but many of these stocks delivered strong returns since November and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment towards Avery Dennison Corporation (NYSE:AVY) changed recently.

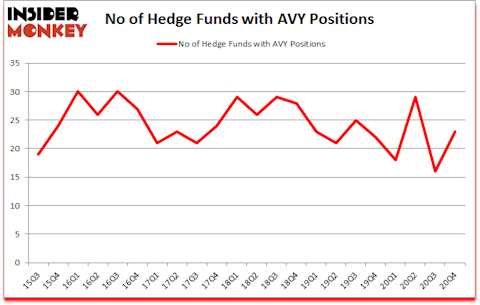

Is AVY stock a buy? Avery Dennison Corporation (NYSE:AVY) has seen an increase in enthusiasm from smart money in recent months. Avery Dennison Corporation (NYSE:AVY) was in 23 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 30. There were 16 hedge funds in our database with AVY positions at the end of the third quarter. Our calculations also showed that AVY isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 124 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, auto parts business is a recession resistant business, so we are taking a closer look at this discount auto parts stock that is growing at a 196% annualized rate. We go through lists like the 15 best micro-cap stocks to buy now to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now we’re going to review the key hedge fund action regarding Avery Dennison Corporation (NYSE:AVY).

Do Hedge Funds Think AVY Is A Good Stock To Buy Now?

At Q4’s end, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the previous quarter. The graph below displays the number of hedge funds with bullish position in AVY over the last 22 quarters. With hedge funds’ sentiment swirling, there exists a few noteworthy hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Avery Dennison Corporation (NYSE:AVY), which was worth $84.8 million at the end of the fourth quarter. On the second spot was Egerton Capital Limited which amassed $57.6 million worth of shares. AQR Capital Management, Scopus Asset Management, and Point72 Asset Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Appian Way Asset Management allocated the biggest weight to Avery Dennison Corporation (NYSE:AVY), around 9.06% of its 13F portfolio. Running Oak Capital is also relatively very bullish on the stock, designating 2.01 percent of its 13F equity portfolio to AVY.

As one would reasonably expect, key money managers have been driving this bullishness. Egerton Capital Limited, managed by John Armitage, initiated the largest position in Avery Dennison Corporation (NYSE:AVY). Egerton Capital Limited had $57.6 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also made a $28.5 million investment in the stock during the quarter. The other funds with brand new AVY positions are Richard Schimel and Lawrence Sapanski’s Cinctive Capital Management, David Harding’s Winton Capital Management, and Minhua Zhang’s Weld Capital Management.

Let’s now review hedge fund activity in other stocks similar to Avery Dennison Corporation (NYSE:AVY). These stocks are Sociedad Química y Minera de Chile S.A. (NYSE:SQM), Huntington Bancshares Incorporated (NASDAQ:HBAN), Guardant Health, Inc. (NASDAQ:GH), Alliant Energy Corporation (NASDAQ:LNT), Erie Indemnity Company (NASDAQ:ERIE), Hasbro, Inc. (NASDAQ:HAS), and Elastic N.V. (NYSE:ESTC). All of these stocks’ market caps match AVY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SQM | 14 | 169166 | 2 |

| HBAN | 29 | 88620 | 2 |

| GH | 52 | 1537691 | 11 |

| LNT | 29 | 276325 | -1 |

| ERIE | 7 | 44866 | -7 |

| HAS | 36 | 356289 | 5 |

| ESTC | 49 | 2229419 | 13 |

| Average | 30.9 | 671768 | 3.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.9 hedge funds with bullish positions and the average amount invested in these stocks was $672 million. That figure was $313 million in AVY’s case. Guardant Health, Inc. (NASDAQ:GH) is the most popular stock in this table. On the other hand Erie Indemnity Company (NASDAQ:ERIE) is the least popular one with only 7 bullish hedge fund positions. Avery Dennison Corporation (NYSE:AVY) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AVY is 50.8. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. A small number of hedge funds were also right about betting on AVY as the stock returned 28.5% since the end of the fourth quarter (through 4/19) and outperformed the market by an even larger margin.

Follow Avery Dennison Corp (NYSE:AVY)

Follow Avery Dennison Corp (NYSE:AVY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.