After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Autohome Inc (NYSE:ATHM).

Hedge fund interest in Autohome Inc (NYSE:ATHM) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as NiSource Inc. (NYSE:NI), Enel Americas S.A. (NYSE:ENIA), and Pearson PLC (NYSE:PSO) to gather more data points.

If you’d ask most stock holders, hedge funds are assumed to be worthless, outdated investment vehicles of the past. While there are greater than 8,000 funds in operation at present, We look at the aristocrats of this club, around 700 funds. Most estimates calculate that this group of people have their hands on the lion’s share of all hedge funds’ total asset base, and by keeping track of their top picks, Insider Monkey has unearthed a few investment strategies that have historically defeated the broader indices. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Cliff Asness of AQR Capital Management

Let’s review the recent hedge fund action encompassing Autohome Inc (NYSE:ATHM).

What does the smart money think about Autohome Inc (NYSE:ATHM)?

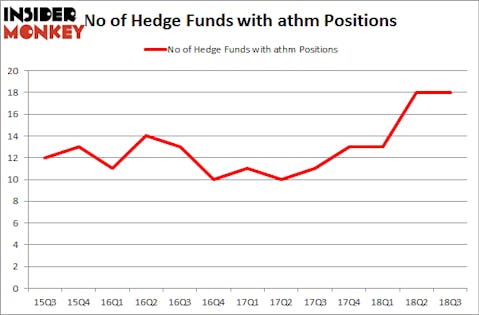

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, representing no change from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in ATHM over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Autohome Inc (NYSE:ATHM) was held by Orbis Investment Management, which reported holding $495.3 million worth of stock at the end of September. It was followed by D E Shaw with a $41.1 million position. Other investors bullish on the company included AQR Capital Management, Sensato Capital Management, and GLG Partners.

Seeing as Autohome Inc (NYSE:ATHM) has witnessed falling interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of funds who were dropping their entire stakes last quarter. It’s worth mentioning that D. E. Shaw’s D E Shaw said goodbye to the largest position of all the hedgies watched by Insider Monkey, valued at about $2.9 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dumped its stock, about $1.4 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Autohome Inc (NYSE:ATHM) but similarly valued. These stocks are NiSource Inc. (NYSE:NI), Enel Americas S.A. (NYSE:ENIA), Pearson PLC (NYSE:PSO), and NVR, Inc. (NYSE:NVR). All of these stocks’ market caps are closest to ATHM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NI | 13 | 626278 | 0 |

| ENIA | 11 | 60929 | 0 |

| PSO | 3 | 18126 | -3 |

| NVR | 25 | 847007 | 4 |

| Average | 13 | 388085 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $388 million. That figure was $616 million in ATHM’s case. NVR, Inc. (NYSE:NVR) is the most popular stock in this table. On the other hand Pearson PLC (NYSE:PSO) is the least popular one with only 3 bullish hedge fund positions. Autohome Inc (NYSE:ATHM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NVR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.