After several tireless days we have finished crunching the numbers from nearly 750 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of March 31. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards AT&T Inc. (NYSE:T).

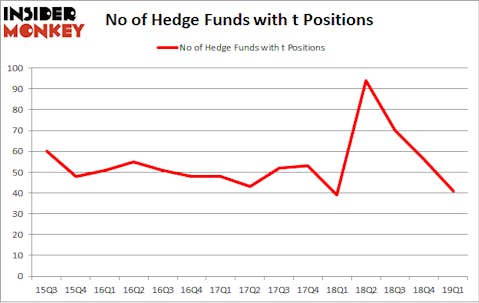

AT&T Inc. (NYSE:T) investors should be aware of a decrease in activity from the world’s largest hedge funds lately. T was in 41 hedge funds’ portfolios at the end of March. There were 56 hedge funds in our database with T holdings at the end of the previous quarter. Our calculations also showed that t isn’t among the 30 most popular stocks among hedge funds.

At the moment there are tons of signals stock market investors employ to assess publicly traded companies. A duo of the less utilized signals are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can beat the S&P 500 by a significant amount (see the details here).

Let’s analyze the latest hedge fund action surrounding AT&T Inc. (NYSE:T).

What does the smart money think about AT&T Inc. (NYSE:T)?

Heading into the second quarter of 2019, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. By comparison, 39 hedge funds held shares or bullish call options in T a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Among these funds, Adage Capital Management held the most valuable stake in AT&T Inc. (NYSE:T), which was worth $249.8 million at the end of the first quarter. On the second spot was D E Shaw which amassed $238.8 million worth of shares. Moreover, Citadel Investment Group, Renaissance Technologies, and D E Shaw were also bullish on AT&T Inc. (NYSE:T), allocating a large percentage of their portfolios to this stock.

Judging by the fact that AT&T Inc. (NYSE:T) has experienced declining sentiment from the smart money, it’s easy to see that there was a specific group of money managers who were dropping their entire stakes last quarter. Intriguingly, Clint Carlson’s Carlson Capital cut the biggest stake of the 700 funds watched by Insider Monkey, comprising close to $46.2 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund sold off about $34.1 million worth. These moves are interesting, as aggregate hedge fund interest fell by 15 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to AT&T Inc. (NYSE:T). These stocks are Novartis AG (NYSE:NVS), Wells Fargo & Company (NYSE:WFC), The Home Depot, Inc. (NYSE:HD), and The Boeing Company (NYSE:BA). This group of stocks’ market values match T’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVS | 33 | 1984333 | -1 |

| WFC | 73 | 25750715 | -4 |

| HD | 58 | 3544213 | 0 |

| BA | 71 | 4346311 | 4 |

| Average | 58.75 | 8906393 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 58.75 hedge funds with bullish positions and the average amount invested in these stocks was $8906 million. That figure was $1084 million in T’s case. Wells Fargo & Company (NYSE:WFC) is the most popular stock in this table. On the other hand Novartis AG (NYSE:NVS) is the least popular one with only 33 bullish hedge fund positions. AT&T Inc. (NYSE:T) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on T as the stock returned 3.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.