As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about Atara Biotherapeutics Inc (NASDAQ:ATRA).

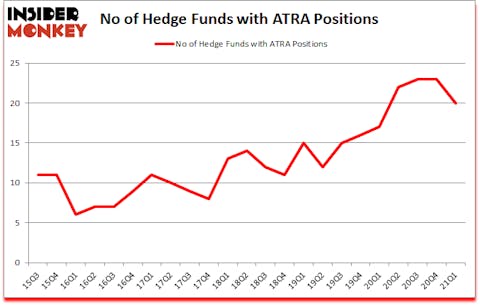

Is ATRA a good stock to buy? Atara Biotherapeutics Inc (NASDAQ:ATRA) investors should be aware of a decrease in enthusiasm from smart money recently. Atara Biotherapeutics Inc (NASDAQ:ATRA) was in 20 hedge funds’ portfolios at the end of the first quarter of 2021. The all time high for this statistic is 23. There were 23 hedge funds in our database with ATRA holdings at the end of December. Our calculations also showed that ATRA isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings).

In the eyes of most shareholders, hedge funds are viewed as unimportant, outdated investment tools of the past. While there are over 8000 funds in operation at the moment, We look at the upper echelon of this group, approximately 850 funds. These hedge fund managers direct most of all hedge funds’ total capital, and by keeping track of their top picks, Insider Monkey has found numerous investment strategies that have historically defeated the market. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 206.8% since March 2017 (through May 2021) and beat the S&P 500 Index by more than 115 percentage points. You can download a sample issue of this newsletter on our website .

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, pet market is growing at a 7% annual rate and is expected to reach $110 billion in 2021. So, we are checking out the 5 best stocks for animal lovers. We go through lists like the 15 best Jim Cramer stocks to identify the next Tesla that will deliver outsized returns. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to go over the key hedge fund action encompassing Atara Biotherapeutics Inc (NASDAQ:ATRA).

Do Hedge Funds Think ATRA Is A Good Stock To Buy Now?

At the end of March, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in ATRA a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Baupost Group was the largest shareholder of Atara Biotherapeutics Inc (NASDAQ:ATRA), with a stake worth $121.7 million reported as of the end of March. Trailing Baupost Group was Redmile Group, which amassed a stake valued at $98.9 million. Maverick Capital, Bridger Management, and Consonance Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Antipodean Advisors allocated the biggest weight to Atara Biotherapeutics Inc (NASDAQ:ATRA), around 4.44% of its 13F portfolio. Consonance Capital Management is also relatively very bullish on the stock, setting aside 2.56 percent of its 13F equity portfolio to ATRA.

Because Atara Biotherapeutics Inc (NASDAQ:ATRA) has experienced bearish sentiment from hedge fund managers, it’s easy to see that there is a sect of funds that elected to cut their positions entirely last quarter. Interestingly, Frank Fu’s CaaS Capital cut the largest investment of all the hedgies tracked by Insider Monkey, valued at an estimated $3.9 million in stock, and Matthew L Pinz’s Pinz Capital was right behind this move, as the fund dumped about $2.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Atara Biotherapeutics Inc (NASDAQ:ATRA). These stocks are The Bancorp, Inc. (NASDAQ:TBBK), iTeos Therapeutics, Inc. (NASDAQ:ITOS), Seabridge Gold, Inc. (NYSE:SA), Playa Hotels & Resorts N.V. (NASDAQ:PLYA), National HealthCare Corporation (NYSE:NHC), Ribbon Communications Inc. (NASDAQ:RBBN), and Oasis Petroleum Inc. (NASDAQ:OAS). This group of stocks’ market values resemble ATRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TBBK | 18 | 100912 | 0 |

| ITOS | 12 | 246149 | -3 |

| SA | 8 | 96749 | -1 |

| PLYA | 26 | 348138 | 3 |

| NHC | 6 | 56897 | -3 |

| RBBN | 15 | 51556 | 5 |

| OAS | 17 | 173658 | 3 |

| Average | 14.6 | 153437 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.6 hedge funds with bullish positions and the average amount invested in these stocks was $153 million. That figure was $434 million in ATRA’s case. Playa Hotels & Resorts N.V. (NASDAQ:PLYA) is the most popular stock in this table. On the other hand National HealthCare Corporation (NYSE:NHC) is the least popular one with only 6 bullish hedge fund positions. Atara Biotherapeutics Inc (NASDAQ:ATRA) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for ATRA is 63.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 23.8% in 2021 through July 16th and beat the market again by 7.7 percentage points. Unfortunately ATRA wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on ATRA were disappointed as the stock returned -7.7% since the end of March (through 7/16) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Atara Biotherapeutics Inc. (NASDAQ:ATRA)

Follow Atara Biotherapeutics Inc. (NASDAQ:ATRA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Most Popular Finance Podcasts

- 10 Best Dividend Stocks to Buy and Hold According to Tiger Cub Lee Ainslie

- 10 Best Stocks that will Benefit from Biden’s $6 Trillion Plan

Disclosure: None. This article was originally published at Insider Monkey.