ClearBridge Investments, an investment management company, released its “ClearBridge Sustainability Leaders Strategy” fourth 2022 investor letter. A copy of the same can be downloaded here. The strategy underperformed its benchmark, the Russell 3000 Index, in the fourth quarter. In the quarter, the strategy gained in eight of the ten sectors it invested in on an absolute basis. Health care, financials, and IT sectors were the leading contributors while communication services and utility sectors detracted from the performance. Stock selection was favorable on a relative basis while sector allocation detracted from the performance. In addition, please check the fund’s top five holdings to know its best picks in 2022.

ClearBridge Sustainability Leaders Strategy highlighted stocks like ASML Holding N.V. (NASDAQ:ASML) in the Q4 2022 investor letter. Headquartered in Veldhoven, the Netherlands, ASML Holding N.V. (NASDAQ:ASML) engages in semiconductor equipment systems development. On March 3, 2023, ASML Holding N.V. (NASDAQ:ASML) stock closed at $637.38 per share. One-month return of ASML Holding N.V. (NASDAQ:ASML) was -3.71%, and its shares gained 10.98% of their value over the last 52 weeks. ASML Holding N.V. (NASDAQ:ASML) has a market capitalization of $251.504 billion.

ClearBridge Sustainability Leaders Strategy made the following comment about ASML Holding N.V. (NASDAQ:ASML) in its Q4 2022 investor letter:

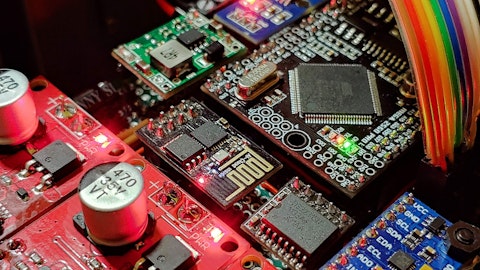

“ASML Holding N.V. (NASDAQ:ASML) makes semiconductor chip manufacturing equipment and is a leading supplier of lithography systems to the semiconductor industry. We expect ASML to grow above expectations as its innovative EUV technology is deployed and industry capacity expands. This in turn should lead to margin expansion and earnings leverage. In addition to more visible growth and profitability drivers relative to Intel, ASML also has a stronger balance sheet and higher returns on capital. As a semiconductor capital equipment provider, ASML directly improves the energy efficiency of semiconductor manufacturing, and governance and diversity initiatives at ASML are best in class.”

l-n-r2tVRjxzFM8-unsplash

ASML Holding N.V. (NASDAQ:ASML) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 59 hedge fund portfolios held ASML Holding N.V. (NASDAQ:ASML) at the end of the fourth quarter which was 51 in the previous quarter.

We discussed ASML Holding N.V. (NASDAQ:ASML) in another article and shared the list of high growth high margin stocks to buy. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Biggest Payment Companies in the World

- 10 Best Stocks to Buy for High Returns

- 12 High Growth SaaS Stocks that are Profitable

Disclosure: None. This article is originally published at Insider Monkey.