Is Argan, Inc. (NYSE:AGX) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

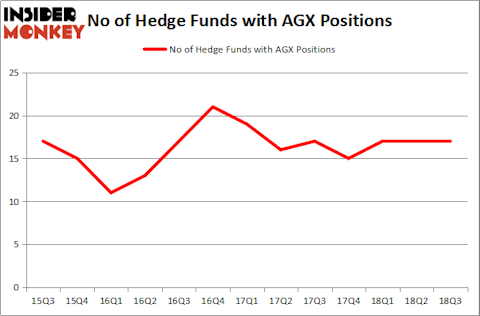

Hedge fund interest in Argan, Inc. (NYSE:AGX) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Dime Community Bancshares, Inc. (NASDAQ:DCOM), Kura Oncology, Inc. (NASDAQ:KURA), and Scorpio Tankers Inc. (NYSE:STNG) to gather more data points.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the latest hedge fund action regarding Argan, Inc. (NYSE:AGX).

Hedge fund activity in Argan, Inc. (NYSE:AGX)

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the second quarter of 2018. By comparison, 15 hedge funds held shares or bullish call options in AGX heading into this year. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Argan, Inc. (NYSE:AGX), with a stake worth $38.9 million reported as of the end of September. Trailing Renaissance Technologies was Royce & Associates, which amassed a stake valued at $24.3 million. Hawk Ridge Management, AQR Capital Management, and Fairfax Financial Holdings were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Argan, Inc. (NYSE:AGX) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there was a specific group of fund managers who were dropping their entire stakes last quarter. At the top of the heap, D. E. Shaw’s D E Shaw sold off the biggest stake of the 700 funds followed by Insider Monkey, totaling about $1 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dropped about $0.6 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Argan, Inc. (NYSE:AGX). We will take a look at Dime Community Bancshares, Inc. (NASDAQ:DCOM), Kura Oncology, Inc. (NASDAQ:KURA), Scorpio Tankers Inc. (NYSE:STNG), and Matrix Service Co (NASDAQ:MTRX). All of these stocks’ market caps are similar to AGX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCOM | 13 | 43461 | 1 |

| KURA | 20 | 217308 | 2 |

| STNG | 14 | 62267 | -1 |

| MTRX | 12 | 61071 | 1 |

| Average | 14.75 | 96027 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $118 million in AGX’s case. Kura Oncology, Inc. (NASDAQ:KURA) is the most popular stock in this table. On the other hand Matrix Service Co (NASDAQ:MTRX) is the least popular one with only 12 bullish hedge fund positions. Argan, Inc. (NYSE:AGX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KURA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.