How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Ares Capital Corporation (NASDAQ:ARCC).

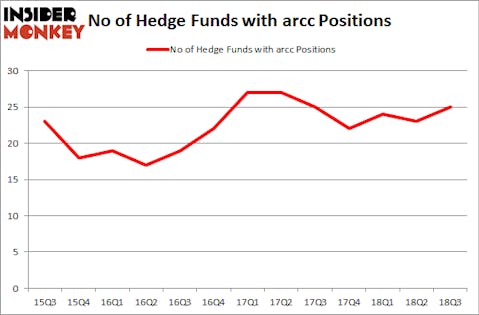

Ares Capital Corporation (NASDAQ:ARCC) has experienced an increase in hedge fund sentiment in recent months. Our calculations also showed that arcc isn’t among the 30 most popular stocks among hedge funds.

To the average investor there are dozens of metrics stock market investors employ to assess their holdings. A couple of the most underrated metrics are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite money managers can outpace the broader indices by a significant margin (see the details here).

Let’s check out the latest hedge fund action regarding Ares Capital Corporation (NASDAQ:ARCC).

Hedge fund activity in Ares Capital Corporation (NASDAQ:ARCC)

At Q3’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 9% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards ARCC over the last 13 quarters. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, D E Shaw, managed by D. E. Shaw, holds the most valuable position in Ares Capital Corporation (NASDAQ:ARCC). D E Shaw has a $63.9 million position in the stock, comprising 0.1% of its 13F portfolio. Coming in second is John Overdeck and David Siegel of Two Sigma Advisors, with a $37.8 million position; 0.1% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions consist of Charles Clough’s Clough Capital Partners, Anand Parekh’s Alyeska Investment Group and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most outsized position in Ares Capital Corporation (NASDAQ:ARCC). Marshall Wace LLP had $12.5 million invested in the company at the end of the quarter. Daniel Johnson’s Gillson Capital also made a $7.4 million investment in the stock during the quarter. The following funds were also among the new ARCC investors: Sander Gerber’s Hudson Bay Capital Management and Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks similar to Ares Capital Corporation (NASDAQ:ARCC). We will take a look at Hubbell Incorporated (NYSE:HUBB), Jefferies Financial Group Inc. (NYSE:JEF), Affiliated Managers Group, Inc. (NYSE:AMG), and Ubiquiti Networks Inc (NASDAQ:UBNT). This group of stocks’ market values are similar to ARCC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HUBB | 27 | 780075 | 5 |

| JEF | 39 | 724586 | 5 |

| AMG | 32 | 732597 | 6 |

| UBNT | 16 | 336685 | 1 |

| Average | 28.5 | 643486 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.5 hedge funds with bullish positions and the average amount invested in these stocks was $643 million. That figure was $285 million in ARCC’s case. Jefferies Financial Group Inc. (NYSE:JEF) is the most popular stock in this table. On the other hand Ubiquiti Networks Inc (NASDAQ:UBNT) is the least popular one with only 16 bullish hedge fund positions. Ares Capital Corporation (NASDAQ:ARCC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard JEF might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.